Here is what actually matters: opportunity charging only works with lithium-ion batteries. Anyone who tells a facility manager to implement opportunity charging on a lead-acid fleet is either ignorant or selling something. The physics of lead-acid chemistry makes opportunity charging a slow-motion battery murder. Yet this advice gets dispensed constantly, usually by vendors who want to sell chargers without selling batteries.

The 8-8-8 rule that governed electric forklifts since the 1970s—8 hours run, 8 hours charge, 8 hours cool—was never best practice. It was the only way lead-acid batteries could survive. Lithium-ion broke that constraint around 2015. The industry spent the next five years pretending nothing had changed.

Why Lead-Acid Dies Under Opportunity Charging

Skip this section if lead-acid chemistry is familiar territory.

Lead-acid batteries need gassing. Not want. Need. The bubbles that form during late-stage charging stir the electrolyte and prevent acid stratification. Sulfuric acid is 1.84 times denser than water. Without stirring, acid sinks. The bottom of the plates corrodes from acid concentration. The top of the plates sulfates from acid starvation. Both processes are irreversible.

Modern warehouse operations demand maximum uptime from forklift fleets

Opportunity charging skips the gassing phase every single time. Each partial charge lets stratification worsen. Each partial charge lets sulfate crystals grow larger and harder. A fleet running opportunity charging on lead-acid will see 35-39.7% capacity loss within 18 months. The chemistry is deterministic.

One Midwest distribution center learned this in 2019. They had 34 forklifts, all running lead-acid, all opportunity charged because a consultant told them it would "increase uptime." Eighteen months later they replaced 31 batteries. The remaining 3 were on trucks that happened to get overnight charges regularly because of shift scheduling quirks. Total cost including downtime: north of $400,000. The consultant was long gone.

This is not an isolated incident. This is the standard outcome. The advice keeps circulating because opportunity charging does increase uptime—for about a year—before the battery degradation catches up.

Lithium-Ion: The Only Chemistry That Makes Sense Here

Lithium-ion batteries do not stratify. There is no liquid acid to stratify. The electrolyte is an organic solvent with dissolved lithium salts, uniformly distributed by molecular diffusion. No stirring required. No gassing required. No equalization charge required.

More interesting: lithium-ion batteries prefer shallow cycles.

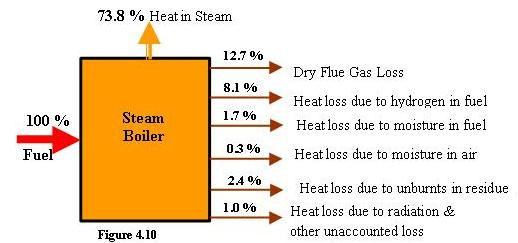

The relationship between cycle depth and total lifetime energy throughput is nonlinear in a way that matters:

A lithium-ion cell cycled 100% depth of discharge delivers roughly 500 full cycles before hitting 80% capacity retention. Total energy throughput: 500 × 100% = 500 equivalent full cycles.

The same cell cycled 30% depth of discharge delivers roughly 2,500 cycles to the same endpoint. Total energy throughput: 2,500 × 30% = 750 equivalent full cycles.

Shallow cycling wins by 50%. Not a theoretical advantage—the operating reality in every facility running lithium-ion opportunity charging.

Opportunity charging naturally imposes shallow cycles. A forklift that plugs in at 60% and unplugs at 80% has done a 20% cycle. Over the course of a day, multiple shallow cycles replace one deep cycle. The battery lasts longer.

Lithium-ion technology has revolutionized forklift fleet management

The Real Numbers

The ROI conversation around lithium-ion opportunity charging is polluted by vendor math. Here are the actual economics, stripped of optimistic assumptions.

Lithium-ion packs for Class I and Class II forklifts run $18,000 to $28,000 depending on voltage and capacity. 36V/600Ah packs cluster around $20,000. 80V/500Ah packs run $24,000 to $28,000. Prices dropped 15% between 2022 and 2024 and appear to be stabilizing.

Lead-acid equivalents cost $6,000 to $14,000 per battery. But multi-shift operations need 2-3 batteries per truck. So the real comparison is $20,000 for one lithium-ion pack versus $12,000 to $42,000 for the lead-acid set. The gap is narrower than the sticker shock suggests.

Infrastructure changes the math further. Lead-acid charging demands:

A dedicated room with ventilation rated for hydrogen gas accumulation. OSHA limits hydrogen concentration to 1% in occupied spaces. Most facilities overengineer to 0.5% to avoid liability.

Battery handling equipment. An 80V lead-acid battery weighs 2,800 to 4,200 pounds. Nobody lifts that by hand. Overhead cranes, roller conveyors, battery carts—the infrastructure runs $30,000 to $80,000 for a 20-truck fleet.

Trained personnel for battery extraction and reinsertion. This task has an injury rate. Insurance actuaries know exactly what it is.

Lithium-ion opportunity charging requires none of this. Wall-mounted chargers distributed near break areas. That is the entire infrastructure. Cost: $15,000 to $25,000 for a 20-truck fleet.

The total cost of ownership calculation over 5 years almost always favors lithium-ion for two-shift operations. The breakeven point typically falls between month 24 and month 30. Three-shift operations break even faster. Single-shift operations may never break even, depending on labor costs and facility constraints.

Where Opportunity Charging Fails

Opportunity charging has boundaries. Pushing past them causes operational chaos.

The fundamental constraint is energy balance. A battery can only accept so much charge in a given time window. If energy consumption exceeds energy replenishment across a 24-hour cycle, the battery state of charge drifts downward day over day until trucks start dying mid-shift.

Rule of thumb: opportunity charging works up to about 14 truck-hours per day under moderate duty cycles. Push to 16-18 hours and the margins get thin. Beyond 18 hours, the math breaks. Fast charging or battery swap becomes necessary.

High-intensity operations require careful energy balance calculations

A 3PL in Southern California tried to stretch opportunity charging across a 20-hour operation in 2021. They had good intentions and bad arithmetic. By week three, the overnight charging window had shrunk to 4 hours as trucks queued for limited charger slots. By week six, first-shift operators were finding trucks at 15% charge. By week eight, management approved an emergency fast-charging installation at triple the normal procurement cost because the line was down and Amazon was threatening contract penalties.

The underlying problem was not lithium-ion chemistry or opportunity charging. The underlying problem was ignoring the energy balance constraint because the projected uptime numbers looked good in a spreadsheet.

Another failure pattern: operator noncompliance. Opportunity charging assumes operators plug in during every break. Human beings do not reliably do things that require walking 50 extra meters. Chargers placed in inconvenient locations go unused. Compliance rates below 60% are common in facilities that treat charger placement as an afterthought.

A food manufacturing plant in Wisconsin achieved 85% charging compliance in the first month after implementation. Twelve months later, compliance had dropped to 48%. Nobody was tracking the metric. Nobody noticed until trucks started failing to complete shifts. The chargers were all located in a designated "charging zone" on the far side of the facility, 120 meters from the break room. Operators had quietly decided that walking to the charging zone was not worth the effort.

The corrective action was obvious once the problem was identified: relocate chargers to the break room entrance. Compliance returned to 80% within three weeks. But the twelve months of suboptimal performance and accelerated battery cycling had already done damage.

LFP Versus NMC: An Actual Opinion

Most technical discussions of lithium-ion chemistry present LFP (lithium iron phosphate) and NMC (nickel manganese cobalt) as tradeoffs to be evaluated based on application requirements. This framing is technically correct and practically useless.

For forklift applications, LFP is the right choice. Period.

NMC offers higher energy density. In a forklift, this advantage is nearly worthless. Forklifts need counterweight. The battery compartment is designed to hold a specific mass. A lighter battery means adding ballast. The energy density advantage becomes a packaging nuisance rather than a benefit.

NMC has worse thermal stability. The decomposition onset temperature is 150-200°C versus 250°C+ for LFP. In a warehouse that might see temperature excursions, electrical faults, or charger malfunctions, this difference matters. LFP fails gracefully. NMC can fail catastrophically. A thermal runaway event in a forklift battery is a warehouse fire. Warehouse fires end careers.

Battery chemistry choice directly impacts operational safety and reliability

NMC costs more. Cobalt is expensive and ethically fraught. NMC manufacturers have spent a decade trying to reduce cobalt content (hence the progression from NMC 111 to NMC 532 to NMC 811). LFP contains no cobalt. The cost trajectory favors LFP and has for years.

NMC has shorter cycle life. Under the shallow-cycle regime of opportunity charging, the gap widens further. NMC packs might deliver 2,000 cycles to 80% capacity. LFP packs routinely deliver 3,500 to 4,000.

The only scenario where NMC makes sense for forklifts is a weight-constrained specialty application. Very narrow aisle trucks in facilities with structural load limits on mezzanine floors. Even then, LFP usually works with minor design modifications.

The market is moving toward LFP dominance anyway. CATL and BYD have made that outcome inevitable through manufacturing scale. Fighting the trend makes no economic sense.

BMS Quality: The Hidden Variable

A lithium-ion battery pack is only as good as its battery management system. This fact is poorly understood outside of engineering circles, which explains why procurement departments keep selecting packs based on cell brand rather than BMS capability.

The BMS performs cell balancing, SOC estimation, thermal monitoring, and fault protection. All four functions have quality gradients. A pack with Samsung cells and a mediocre BMS will underperform a pack with generic Chinese cells and a sophisticated BMS. Happens constantly.

Cell balancing matters because manufacturing tolerances make every cell in a pack slightly different. The weakest cell limits pack capacity. Without balancing, the weakest cell drifts weaker over time. With good balancing, cells stay matched and the pack delivers its rated capacity for years. With bad balancing, capacity fades 5-8% per year beyond the normal degradation curve.

SOC estimation matters because operators and scheduling systems make decisions based on displayed charge level. A BMS that estimates SOC within ±3% enables confident decision-making. A BMS that estimates SOC within ±15%—and plenty do—turns fleet management into guesswork. Trucks displaying 25% might actually be at 10% or 40%. Nobody knows until something goes wrong.

When evaluating battery suppliers, request BMS specifications. Request balancing current and balancing algorithm documentation. Request SOC estimation methodology. Suppliers who cannot provide this information are reselling packs they do not fully understand. There are many such suppliers.

Cold Storage: A Special Case

Cold storage warehouses below -10°C impose constraints that break standard opportunity charging assumptions.

Lead-acid batteries become nearly useless below freezing. Capacity drops 30-50% at -20°C. Electrolyte viscosity increases, internal resistance spikes, and the battery cannot deliver rated current. Many cold storage operations run their lead-acid forklifts into the warm zone for charging, which adds logistics complexity and reduces effective productivity.

Cold storage environments present unique challenges for battery performance

Lithium-ion batteries tolerate cold discharge reasonably well. LFP retains 70-80% of rated capacity at -20°C. But charging below 0°C is dangerous. Lithium ions cannot insert into the graphite anode properly at low temperatures. Instead of intercalating, they plate as metallic lithium on the anode surface. Lithium plating is irreversible capacity loss. Severe plating causes internal short circuits and thermal events.

Cold storage lithium-ion systems require battery heating before charging can begin. The BMS monitors cell temperature and holds the charger in standby until the pack warms above 0°C, typically 5°C with a safety margin. This adds 15-30 minutes to each charging session. Energy balance calculations must account for this delay.

The alternative is locating chargers in a warm anteroom and requiring operators to exit the cold zone for charging. This adds travel time and reduces compliance. Neither option is ideal. Cold storage opportunity charging works, but it works with constraints that facilities in temperate environments do not face.

Implementation Mistakes Worth Avoiding

After watching multiple opportunity charging rollouts, certain failure patterns recur often enough to merit explicit warning.

Deploying opportunity charging without measuring actual energy consumption first is gambling. Supplier datasheets provide nominal consumption figures. Real-world consumption varies with load weight, lift height, travel distance, floor surface, ramp grades, and operator behavior. The variance can be 40% or more.

The correct approach: instrument 3-5 representative trucks with energy monitoring for two weeks before system design. Measure actual consumption under actual operating conditions. Size the system to measured reality, not to optimistic projections.

Charger placement trips up more implementations than any technical issue. Electrical contractors want to minimize cable runs. Operators want to minimize walking. These incentives conflict. Operator convenience must win. Every meter of additional walking distance reduces charging compliance measurably. A charger placed 80 meters from the break room might as well not exist.

Behavior change without enforcement does not stick. Opportunity charging requires plugging in during every break. New habits require reinforcement. Without visible tracking, without feedback, without consequences for noncompliance, the habit fades. Within six months, charging discipline in an unenforced environment typically drops below 50%.

Effective implementation requires careful attention to human factors

Effective enforcement does not require punitive measures. Public dashboards showing compliance by shift and by team create social pressure. Recognition for high compliance creates positive reinforcement. The mere knowledge that someone is watching changes behavior. Hidden tracking with no feedback changes nothing.

Overnight charging gets neglected. Opportunity charging tops batteries up during the day but rarely brings them to 100%. A battery that finishes Friday at 75% and sits uncharged until Monday has lost 5-7% to self-discharge and may start the week behind. Overnight charging protocols ensure batteries begin each operational day near full capacity. Skipping this discipline erodes the energy buffer that makes opportunity charging work.

What Comes Next

Wireless charging is coming. Inductive pads embedded in the floor eliminate the plug-in action entirely. A forklift parked over a pad charges automatically. No operator involvement. No compliance problem. Pilot installations exist at several major retailers. Efficiency is above 90%. The obstacle is cost: retrofitting floor-mounted pads into an existing facility runs $3,000 to $5,000 per charging position, plus electrical infrastructure. New construction is cheaper. Within five years, wireless charging will be standard in new warehouse builds. Retrofits will follow as costs decline.

Intelligent scheduling is emerging. Current systems charge based on simple SOC thresholds. Smarter systems will predict workload, optimize charging timing against electricity price curves, and balance wear across the fleet. The technology exists. Deployment lags because most warehouse management systems cannot feed real-time task data to the charging infrastructure. Integration is the bottleneck, not algorithms.

Vehicle-to-grid capability exists in theory. Forklift batteries could discharge to the grid during peak demand and recharge during off-peak hours, capturing the price spread as revenue. In practice, the complexity of grid interconnection, metering, and settlement makes V2G uneconomic for most facilities today. Regulatory simplification might change this. Or might not. The timeline is uncertain.

Opportunity charging is straightforward in concept and demanding in execution. The concept: plug in whenever possible. The execution: get the battery chemistry right, get the charger placement right, get the operator compliance right, and respect the energy balance constraint.

Facilities that execute well see 20-40% productivity gains over lead-acid conventional charging, with lower total cost of ownership starting around year two. Facilities that execute poorly see accelerated battery degradation, unreliable equipment availability, and expensive midstream corrections.

The technology is proven. The economics are favorable. The implementation is where operations succeed or fail.

LFP lithium-ion is the correct battery chemistry for nearly all forklift opportunity charging applications. NMC is a niche choice that most facilities should avoid. Lead-acid is incompatible with opportunity charging and anyone suggesting otherwise is wrong.

Chargers belong where operators already pause, not where electrical runs are convenient. Compliance monitoring is mandatory, not optional. Energy balance calculations must use measured data, not supplier estimates.

These are not opinions. These are patterns observed across dozens of implementations. The facilities that ignore them learn the lessons expensively. The facilities that heed them capture the benefits without the drama.