The Best Microgrid Battery Storage Solutions

The Battery Problem

Most microgrid projects fail because someone skimped on the battery.

The pattern is always the same. Project team spends months optimizing solar panel angles and inverter specs. Budget runs tight toward the end. Someone suggests a smaller battery, cheaper chemistry, fewer hours of backup. The consultant runs revised numbers. The math looks okay if you squint. Everyone signs off.

Then the first real outage hits.

Grid goes down for 36 hours during a storm. The battery, sized for 8 hours with optimistic assumptions about solar recharge, dies at hour 12 when clouds roll in. The diesel generator that was supposed to be obsolete gets dragged out of storage. The CFO asks uncomfortable questions. The consultant who signed off on the undersized battery is suddenly unavailable.

This happens constantly. Not occasionally. Constantly.

Batteries are boring. Solar panels photograph well for press releases. Control rooms with glowing screens impress site visitors. Ribbon-cutting ceremonies happen in front of solar arrays, not battery containers. So when budgets tighten, the battery gets squeezed first. Shave a few kilowatt-hours here, downgrade the chemistry there, assume slightly more optimistic solar production. The incremental compromises add up until the system cannot actually do what it was built to do.

The logic is exactly backwards. A mediocre solar array paired with an oversized, high-quality battery will outperform a premium solar installation with compromised storage. Every time. Not sometimes. Every time. The battery is the system. Everything else feeds it or draws from it.

Project developers who understand this build systems that work. Project developers who treat batteries as an afterthought build expensive disappointments.

LFP Won.

Anyone still specifying nickel-manganese-cobalt chemistry for stationary storage is either working from information that became obsolete around 2020, or has a supplier relationship that clouds their judgment, or both.

The Arizona explosion in 2019 should have ended this conversation permanently. Standard commercial NMC installation, nothing unusual about it, experienced thermal runaway during normal operations. One cell overheated. The heat spread to neighboring cells. Those cells released oxygen as they broke down, feeding a fire that no suppression system could stop. The building exploded. Four firefighters went to the hospital.

The investigation found nothing wrong with the installation. No manufacturing defect. No installation error. No operational abuse. The battery just did what NMC batteries sometimes do when conditions align badly. The chemistry contains oxygen in a molecular structure that becomes unstable at high temperatures. Heat a cell enough and it releases that oxygen, which feeds combustion, which heats neighboring cells, which release their oxygen. The cascade is self-sustaining once it starts.

Insurance companies understood the implications before most of the industry did. Premium quotes for NMC installations started climbing within months of Arizona. Some underwriters stopped writing coverage for stationary NMC entirely. They did the actuarial math and decided the tail risk was unacceptable at any premium they could charge.

Project developers who had always specified NMC because their consultants had always specified NMC suddenly found themselves unable to get insurance. Or able to get insurance only at premiums that destroyed project economics. The market made the decision that the engineering community should have made years earlier.

LFP chemistry avoids this failure mode entirely. The molecular structure holds oxygen in a different configuration. Heat one cell to complete destruction and the neighbors barely notice. You can drive a nail through an LFP cell and the pack keeps running minus one cell. Try that with NMC and call the fire department.

The safety margin matters more as installations scale up. A home battery presents minimal fire risk regardless of chemistry. Not enough energy content to cause serious damage even if everything goes wrong. A utility-scale installation holding enough energy to power a small town is a different situation entirely. The Arizona facility held only a couple of megawatt-hours. Scale that incident to a hundred megawatt-hours and the consequences become genuinely difficult to think about.

Cycle life reinforces the chemistry choice. LFP batteries degrade predictably, losing capacity in a straight line from year one through year twenty. Plot the degradation curve and it looks like what the manufacturer promised. Financial models built on these curves hold up when audited five years later.

NMC batteries degrade differently. Capacity may hold steady for years, looking great in quarterly reports, then fall off a cliff without warning. The nonlinear degradation pattern makes financial modeling unreliable. Banks have noticed. Try financing an NMC project today and watch the due diligence questions multiply.

The energy density argument that used to favor NMC has collapsed. Current LFP cells from CATL hit 205 Wh/kg. NMC runs 230 to 280 Wh/kg. The gap is maybe 20 to 30 percent. Who cares? Stationary storage sits on concrete pads. Nobody is carrying it anywhere. The weight difference between a ten-ton container and a twelve-ton container affects nothing. The trucks that deliver them can handle either. The concrete pads that support them can handle either.

Energy density matters for electric vehicles where every kilogram affects range. Tesla still uses NMC in cars for this reason. Tesla uses LFP in Powerwalls and Megapacks. The company that arguably understands batteries better than anyone else on earth made this choice deliberately. That should tell you something.

Tesla. Just Buy Tesla.

The Powerwall 3 dominates residential storage for a reason most competitors cannot fix no matter how hard they try: power output.

Most home batteries top out around five kilowatts continuous. The Powerwall delivers eleven and a half. This single specification determines almost everything about real-world performance during outages.

American homes draw eight to ten kilowatts during peak demand. Air conditioning compressor running. Electric water heater cycling. Someone charging a car in the garage. A five-kilowatt battery cannot run this load. The math does not work. The homeowner either installs automatic load-shedding equipment that adds cost and complexity and failure points, or accepts that backup power means the refrigerator and some lights while the house temperature drifts toward ambient.

The Powerwall runs everything. The air conditioning keeps running. The water heater keeps heating. The car keeps charging. The family continues living normally while the neighbors sit in the dark wondering why they bought the cheaper system.

Enphase has a longer warranty. Fifteen years versus Tesla's ten. This matters to some buyers. The tradeoff is continuous power under four kilowatts. Under four. That is not whole-house backup. That is keeping your internet router alive during an outage. The warranty duration is irrelevant if the product cannot perform the basic function you bought it for.

Everything else in the residential market is forgettable. LG makes decent cells but their residential products lack differentiation. Generac is a generator company that added batteries as a product line extension. Panasonic makes good cells but their system integration is mediocre. Pick whichever one your installer knows best and accept that you are settling for second tier.

At commercial scale the calculus shifts but the conclusion stays the same.

Tesla shipped over thirty gigawatt-hours of energy storage last year. Read that number again. Thirty gigawatt-hours in a single year. Most competitors have not shipped thirty gigawatt-hours total across their entire corporate histories. The manufacturing volume enables pricing that smaller players cannot match without losing money on every unit. The volume enables delivery times that smaller players cannot match because they do not have the production capacity. The volume enables continuous product refinement based on operational data from thousands of installations feeding back into engineering.

The Megapack 3 carries a twenty-year warranty. Twenty years. Most project financing runs fifteen years or less. The warranty outlasts the loan. Banks love this. Battery replacement disappears from the financial model entirely. No replacement reserve. No degradation contingency eating into returns. The battery is warranted to work for the entire financing term plus five years.

Try getting a twenty-year warranty from Fluence. Or from any startup that might not exist in twenty years.

Fluence competes on pedigree rather than product. The Siemens and AES lineage opens doors at regulated utilities where procurement committees trust familiar corporate names over actual performance data. Fine. If your project requires that kind of political cover, Fluence exists. The Utah manufacturing facility qualifies products for federal domestic content bonuses, which matters for projects chasing those incentives. These are real advantages for specific projects with specific constraints.

For everyone else, Fluence is paying a premium for a name.

Chinese manufacturers sell equivalent hardware for twenty to forty percent less. Sungrow and BYD use the same CATL cells that go into Tesla products and Fluence products and everyone else's products. CATL supplies the world. The cells are identical. The cost difference reflects manufacturing location, labor costs, and supply chain efficiency. Not quality.

Projects without domestic content requirements should get quotes from Chinese suppliers and evaluate the numbers honestly. BYD in particular deserves attention. The company builds everything in-house. Cells, thermal management, enclosures, control systems, software. No other supplier matches this vertical integration depth. When something goes wrong with a BYD system, BYD cannot point fingers at component vendors. They made every component. The accountability structure differs from Western integrators who assemble third-party parts and then play blame games when systems underperform.

The geopolitical risk exists. Tariffs could increase. Relations could deteriorate further. Price this risk appropriately. But do not pretend the Chinese products are inferior. They are not.

Most projects should just buy Tesla and stop overthinking it. The product is better. The manufacturing scale is unmatched. The warranty is longer. The company will exist in twenty years. These facts overwhelm the marginal advantages competitors claim in narrow categories.

How Batteries Actually Make Money

Demand charges. Start here. Everything else is secondary.

Commercial electricity bills have two components that confuse people who have only paid residential bills. Energy charges cover kilowatt-hours consumed over the billing period. Demand charges cover peak kilowatts drawn during any interval in the billing period. The interval is usually fifteen minutes. The demand charge covers infrastructure costs because utilities have to build capacity for your worst spike, not your average consumption.

A facility paying fifteen dollars per kilowatt-month for demand charges that spikes to five hundred kilowatts for one fifteen-minute interval pays seventy-five hundred dollars in demand charges. That month. Whether the spike happens once or fifty times. Whether the average load was one hundred kilowatts or four hundred kilowatts.

The math is punitive by design. Utilities want customers to flatten load profiles. Customers with spiky demand impose infrastructure costs that customers with flat demand do not. Demand charges allocate those costs.

Batteries shave peaks. When facility load approaches the target threshold, the battery discharges to cover the gap. The utility meter sees a flat profile. The battery recharges during off-peak hours when demand charges do not apply. Annual savings of thirty thousand, fifty thousand, eighty thousand dollars are common for facilities with spiky profiles. Manufacturing plants with big motors. Commercial kitchens with synchronized equipment. Office buildings with aggressive HVAC schedules.

The catch is predictability. Demand charges apply to the highest interval of the billing period. Every month resets. One unexpected spike erases a whole month of careful management. A motor starting during a load peak. An HVAC system cycling at the wrong moment. Someone plugging in equipment without checking the load monitor. Effective peak shaving requires automated systems that respond faster than humans can.

Energy arbitrage, charging when power is cheap and discharging when expensive, sounds good until you run actual numbers. Efficiency losses eat eight to fifteen percent of every round trip. Battery degradation accelerates with cycling frequency. Price spreads in most markets run five to twenty cents per kilowatt-hour. After losses and degradation, the net margin is thin. You are not going to finance a battery project on arbitrage revenue alone.

Grid services can work for sophisticated operators who genuinely know what they are doing. Frequency regulation pays five to twenty-five dollars per megawatt-hour in most markets. Capacity payments vary by region. Spinning reserve requirements vary by grid operator.

Here is the thing about grid services revenue. If you have to ask how it works, you should not put it in your financial model. Grid services require real-time telemetry to utility control rooms, sub-second response to dispatch signals, and performance guarantees backed by penalties when you miss them. Projects claiming grid services revenue without a team that has actually operated batteries in those markets are speculating. The revenue looks good in spreadsheets and evaporates on contact with operational reality.

The federal tax credit matters more than most other line items. Thirty percent of installed cost for standalone storage over five kilowatt-hours. Bonus adders for prevailing wage compliance, domestic content, and energy community location can push the effective credit above fifty percent. A project qualifying for maximum bonuses cuts installed cost nearly in half through tax benefits alone.

Do not build a project that requires grid services revenue to pencil out. Do build projects around demand charge savings plus tax credits. That combination works reliably.

Grid-Forming Inverters Are Non-Negotiable

This section assumes you know what inverters do. If you do not, stop reading this article and go learn the basics first.

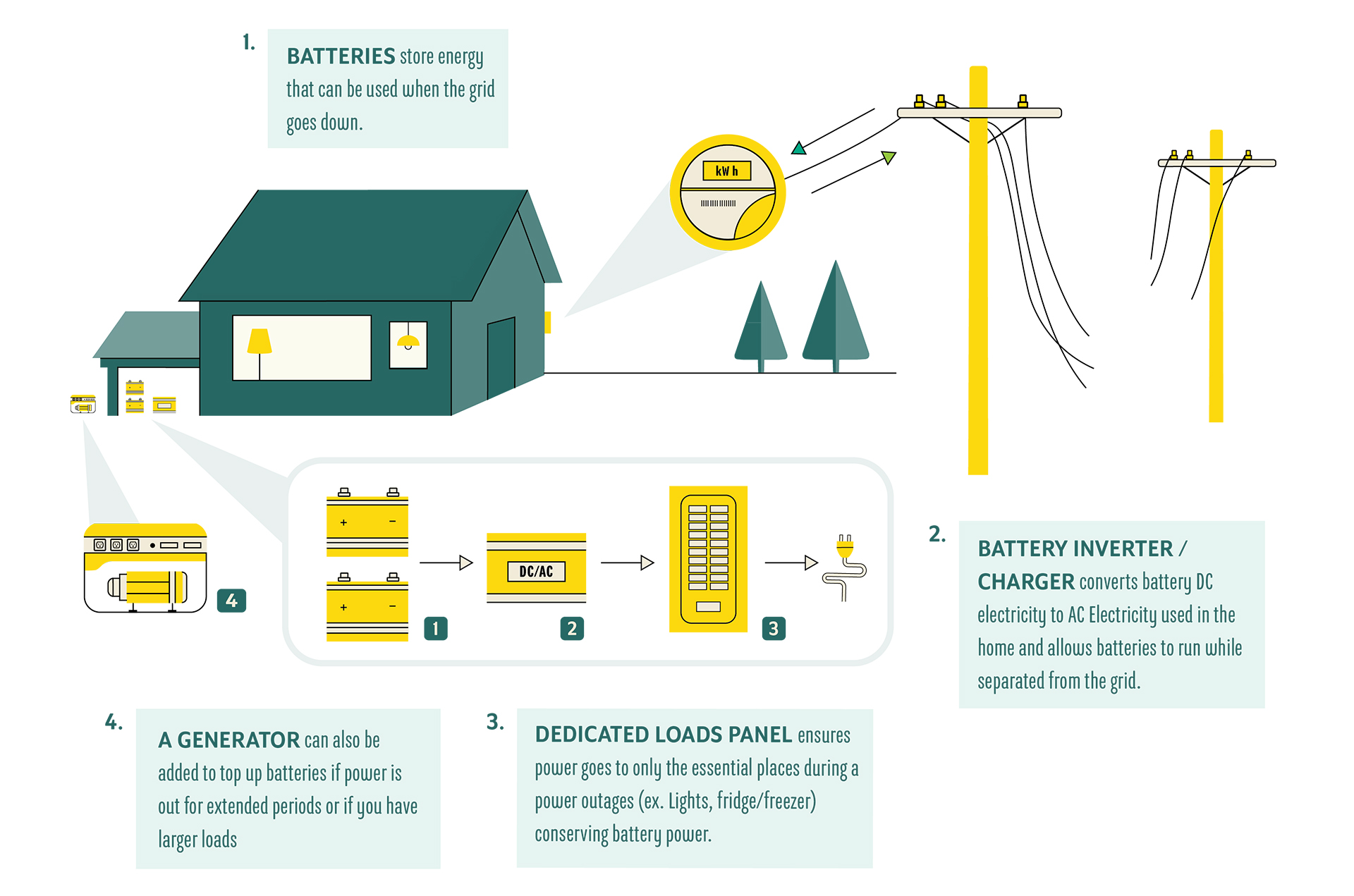

Grid-following inverters synchronize to the utility signal and inject or absorb power as commanded. They cannot establish their own voltage or frequency reference. When the grid disappears, they shut down. Immediately. Automatically. By design.

A microgrid built with grid-following inverters cannot island. When the utility fails, the battery sits fully charged and completely useless. The entire point of building a microgrid, the resilience during grid outages, evaporates. You have built an expensive grid-tied solar-plus-storage system that does exactly what a cheap grid-tied solar system does during outages. Nothing.

This mistake happens more often than it should. The specification difference between grid-forming and grid-following appears in datasheets that most buyers never read carefully. Both types connect to grids. Both charge and discharge batteries. Both claim high efficiency numbers. The sales presentations look similar. The prices look similar. The difference only reveals itself during the first outage when the system fails to island and everyone stands around wondering what went wrong.

Grid-forming inverters cost ten to fifteen percent more. The premium is insignificant relative to total project cost. Any supplier pushing grid-following inverters for a microgrid application either does not understand the fundamental requirements or does not care about delivering a functional system.

ERCOT and MISO now require grid-forming capability for new interconnecting resources in some categories. The regulatory trend will continue as renewable penetration increases and grids need more distributed voltage support. Specify grid-forming now even if your jurisdiction does not yet require it.

Thermal management deserves more attention than it gets. Cells running above 35 Celsius degrade faster than cells running at 25 Celsius. Cells running below zero may suffer permanent damage from lithium plating. The degradation relationship is nonlinear. A few degrees of temperature difference compounds over years into measurable capacity gaps.

Liquid cooling maintains temperature uniformity within two to three degrees across the entire pack. Air cooling allows five to ten degrees of variation. The cells in the center of an air-cooled pack run hotter than cells at the edges. They degrade faster. They pull down the performance of the entire pack. After five years an air-cooled installation shows dramatically uneven cell health. A liquid-cooled installation of the same vintage shows uniform degradation tracking manufacturer projections.

Hot climate installations should specify liquid cooling as mandatory. The upfront premium pays for itself in extended service life. Arizona installations with air cooling have provided expensive lessons in what not to do.

UL 9540A certification tests whether a battery system contains thermal runaway events or allows them to propagate and breach the enclosure. The test forces a cell into thermal runaway through overcharge or overheating and measures what happens next. Products that pass contained the failure to the originating cell or module. Products that fail allowed cascading destruction or fire or both.

Some manufacturers advertise UL 9540 listing rather than UL 9540A testing. These are different certifications. UL 9540 covers general battery safety. UL 9540A specifically addresses thermal runaway propagation. A product can carry UL 9540 listing without demonstrating resistance to cascading failure. Read the certification documents. Ask specifically about 9540A.

Warranty terms require actual review by someone who reads contracts carefully. A ten-year warranty with restrictions limiting operation to one cycle per day provides less real protection than an eight-year warranty without operational restrictions. Verify what conditions void coverage. Verify what remedies the warranty actually provides. Replacement cells, cash payment, or capacity credits are not equivalent.

Bankability letters from DNV or Black and Veatch confirm that someone independent reviewed the manufacturer's financials, production processes, and warranty reserves and concluded the company can plausibly honor its commitments. Startup manufacturers often cannot provide bankability letters because their balance sheets lack the reserves to backstop ten or twenty-year obligations. They offer aggressive warranty terms precisely because they expect to be acquired or restructured or dissolved before claims arrive.

Blue Lake Rancheria

This installation matters more than the others because it was tested by an actual disaster when most microgrids were still theoretical.

Blue Lake Rancheria is a tribal community in Northern California. They deployed solar and battery storage in 2017, before microgrids had become a mainstream concept. The installation serves a casino, hotel, convenience store, and government offices.

October 2017. Wildfires sweep through Northern California. Utilities implement public safety power shutoffs to prevent their equipment from igniting additional fires. Surrounding communities go dark. Not for hours. For days.

Blue Lake Rancheria continues operating. The microgrid islands smoothly. Solar charges the battery during the day. The battery carries loads through the night. The system runs without interruption while communities all around it sit powerless.

The American Red Cross designates the site an emergency shelter. People show up. Residents from surrounding areas who need power for medical equipment. Oxygen concentrators. CPAP machines. Refrigerated medications. Dialysis preparation. People who will die without electricity and whose own power has failed.

County emergency management officials documented afterward that the microgrid prevented loss of life. Not property damage. Not economic loss. Loss of life. People who would have died had somewhere to go instead.

Annual savings run six figures compared to grid-only supply. The system has operated for years now without major equipment failures. Degradation has tracked projections. But the savings are not why this installation matters. What matters is that when a real disaster tested the system, the system worked.

Stone Edge Farm and Kaiser Permanente Ontario deserve mention but less attention. Stone Edge ran for ten days during the Tubbs Fire without human intervention after communication links burned. The automated systems handled everything. Kaiser eliminated diesel backup generators entirely and runs twelve-plus hours of autonomy on solar and battery. Energy costs dropped forty percent. These validate that the technology works across different contexts.

But Blue Lake is the proof that matters. Actual disaster. Actual islanding. Actual lives saved.

New Technologies

Sodium-ion batteries exist now in commercial production. CATL's Naxtra line. Cold weather performance exceeds lithium, which matters for installations in Minnesota or Alberta where LFP needs heating systems below zero. Supply chain avoids lithium entirely.

No long-term field data. The chemistry is proven in laboratories. Deployed systems are young. Conservative projects should wait two to three years for operational track records before specifying sodium-ion for anything important.

Iron-air promises hundred-hour discharge duration at costs around twenty dollars per kilowatt-hour. Form Energy has utility installations commissioning this year. Interesting for grid-scale duration storage across weather systems. Irrelevant for most microgrids because the power density is too low for fast response applications.

Solid-state is years away from anything relevant to stationary storage. Electric vehicles will absorb initial production whenever it reaches commercial scale. Ignore it for microgrid planning purposes.

None of these change what you should specify today. LFP remains the correct choice. When sodium-ion has five-year field data showing reliability matching LFP, reassess. Not before.

Specification Summary

Tesla Powerwall for residential whole-house backup. The power output advantage is decisive. If budget forces compromise, Enphase warranty duration provides some consolation for accepting lower power output.

Tesla Megapack for commercial and utility scale unless specific project constraints require otherwise. The manufacturing scale, warranty duration, and company longevity outweigh marginal advantages competitors claim.

Fluence when utility procurement politics require Siemens lineage or when domestic content bonuses drive economics.

Chinese suppliers when domestic content does not apply and the project can handle geopolitical optics. BYD for vertical integration accountability. Sungrow for cost optimization.

LFP chemistry without exception for new stationary installations.

Grid-forming inverters without exception for any system expected to island.

Liquid cooling for hot climate installations or high duty cycle applications.

UL 9540A certification required. Not 9540. 9540A.

Oversizing by twenty-five percent minimum versus consultant spreadsheet recommendations. Consultants optimize for winning bids, not for surviving outages.

Bankability letters required from manufacturers claiming long warranty terms.

The battery is the system. Size it correctly. Specify the chemistry correctly. Require the safety certifications. Everything else supports what the battery does.