Residential battery installation has become a trade specialty in its own right. The electricians who did panel upgrades and ceiling fan installs ten years ago now find themselves troubleshooting CAN bus communication faults and configuring Modbus registers. The knowledge gap between a competent residential electrician and a competent storage installer grows wider each year.

The Tesla Powerwall changed residential storage from a niche product into a mass-market category starting around 2015. Before that, off-grid solar installers worked with Outback and Magnum inverters paired with flooded lead-acid battery banks that needed monthly watering and annual equalization charges. Those systems demanded attention. The Powerwall promised maintenance-free operation, and largely delivered, but shifted the complexity from ongoing maintenance to upfront installation precision.

The Equipment Selection Problem

Why LFP Won

The residential storage market has consolidated around lithium iron phosphate chemistry. This happened faster than most industry observers predicted in 2018-2019, when NMC-based products like the LG Chem RESU series held significant market share.

The LG Chem recalls of 2020-2021 accelerated the shift. After multiple fire incidents traced to manufacturing defects in the RESU 10H, the industry's risk calculus changed. LG ultimately recalled nearly 10,000 units in Australia alone. The company's response by offering either refunds or replacement with newer LFP-based products, acknowledged the market verdict.

LFP tolerates abuse that would destroy NMC cells. An LFP cell overcharged to 4.0V (versus nominal 3.65V max) suffers accelerated aging but rarely fails catastrophically. An NMC cell at the same overcharge margin enters thermal runaway territory. For residential applications where installation quality varies and monitoring may be intermittent, this tolerance margin matters.

The thermal runaway characteristics differ qualitatively, not just quantitatively. NMC thermal runaway releases oxygen from the cathode lattice, creating a self-sustaining fire even without external oxygen supply. LFP thermal runaway produces heat and gas but no oxygen release. A failing LFP cell can be suppressed with water; a failing NMC cell will reignite until the active material exhausts itself.

The chemistry behind this difference:

LFP uses an olivine crystal structure where oxygen atoms bond covalently to phosphate groups (PO₄). Breaking these bonds requires temperatures exceeding 600°C. The oxygen stays locked in the crystal even as the cell overheats.

NMC uses a layered oxide structure where oxygen bonds ionically to the transition metal lattice. Above 150-200°C, these bonds break, releasing oxygen gas. The oxygen feeds the fire, creating a self-sustaining combustion reaction that cannot be smothered.

So LFP cells can fail into a high-temperature state without catching fire. NMC cells transition from thermal runaway to fire within seconds. For a battery mounted on a garage wall in a residential neighborhood, this distinction between "hot and damaged" versus "actively burning" represents the difference between an expensive warranty claim and a house fire.

BYD, CATL, and EVE Energy supply most of the LFP cells in residential products sold under Western brand names. The Enphase IQ Battery uses cells from two Chinese suppliers. The Tesla Powerwall 3 uses Tesla's own cell production. Sonnen sources from multiple suppliers depending on region and production timing.

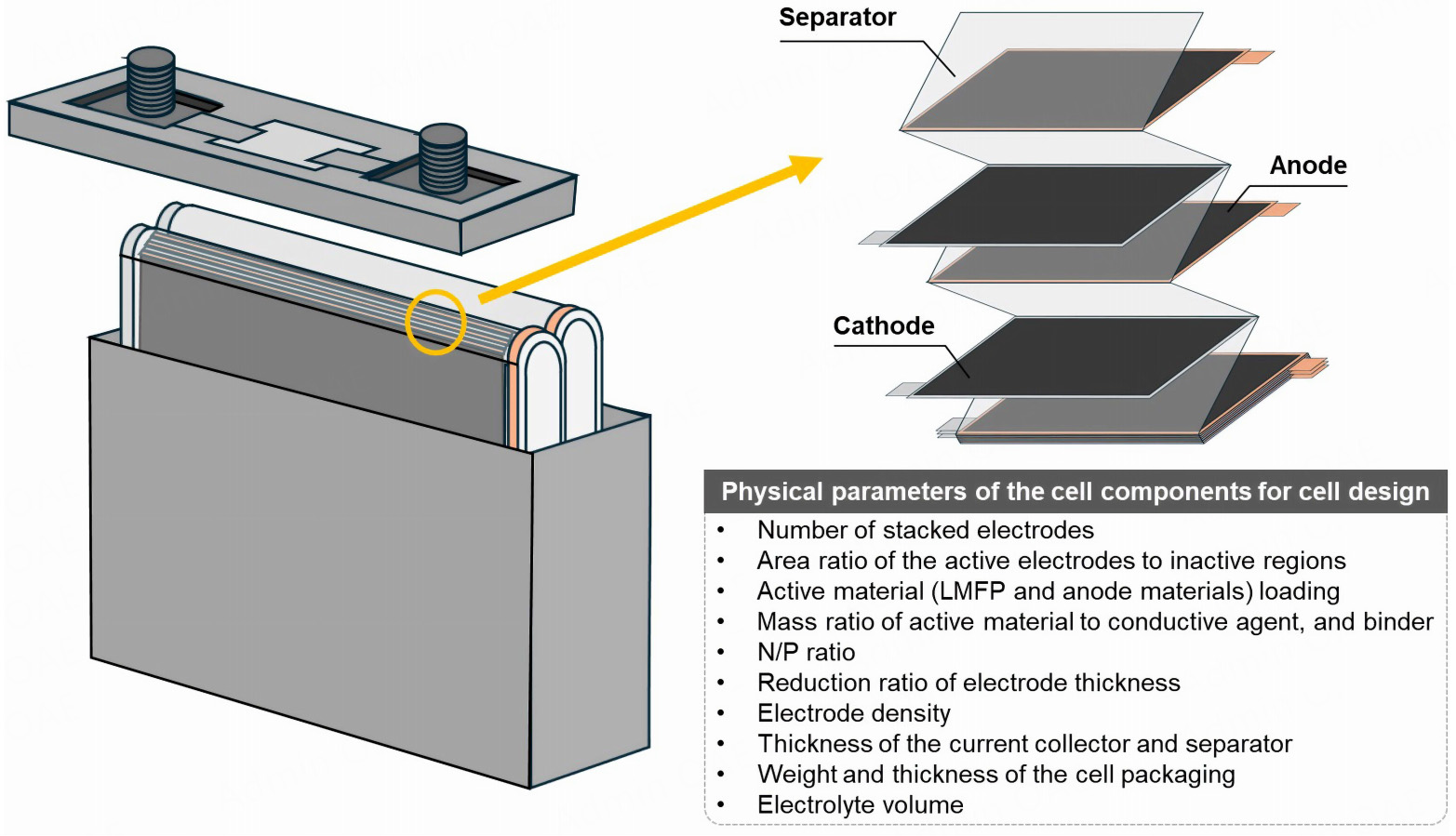

Cell format choices:

Residential batteries use one of three cell formats: cylindrical, prismatic, or pouch.

The Tesla Powerwall uses cylindrical cells (originally 18650 format, now 4680 in newer products). Cylindrical cells have excellent mechanical properties and thermal characteristics due to the round can construction. The downside is packing density: round cells leave void space when arranged in arrays.

BYD Battery-Box Premium uses prismatic cells. The rectangular aluminum cans maximize packing density and simplify mechanical assembly. Prismatic cells are larger than cylindrical cells, meaning fewer cells per pack and fewer welds and connections.

Some products use pouch cells, which are essentially prismatic cells without rigid cans. Pouch cells achieve the highest energy density but require external compression and careful thermal management. The flexible packaging can swell if the cell generates gas internally.

For residential storage, prismatic LFP cells offer the best balance of safety, longevity, and cost. The Tesla approach using cylindrical cells represents a different optimization, using Tesla's massive cylindrical cell manufacturing expertise from vehicle production.

Cell-Level Reliability: What Determines Battery Lifespan

A residential battery is only as reliable as its worst cell. Understanding cell-level failure modes explains why some batteries last 15 years and others fail in 5.

Calendar aging occurs simply from the passage of time, independent of cycling. The SEI layer on the graphite anode continues growing even when the battery sits idle. This growth consumes active lithium and increases internal resistance. Calendar aging accelerates dramatically with temperature and state of charge: a cell stored at 100% SOC and 35°C ages four times faster than a cell stored at 50% SOC and 25°C.

Cycle aging results from repeated charge and discharge. Each cycle causes mechanical stress as lithium ions insert and extract from electrode materials. Graphite anodes expand roughly 10% when fully lithiated. This expansion and contraction cracks the SEI layer, requiring continuous repair that consumes lithium. Cycle aging accelerates with depth of discharge, charge rate, and temperature extremes.

Lithium plating occurs when charging happens too fast at low temperature. Below 0°C, the kinetics of lithium insertion into graphite slow dramatically. If charge current exceeds the insertion rate, metallic lithium deposits on the anode surface. This plated lithium is permanently lost and can form dendrites that eventually short-circuit the cell.

Quality battery management systems prevent lithium plating by reducing charge current at low temperatures and prohibiting charging below specified thresholds. The Tesla Powerwall, for example, will not charge below -20°C and reduces charge rate progressively below 10°C. Products without active thermal management may lack even these basic protections.

Internal short circuits develop from manufacturing defects, physical damage, or dendrite formation. A microscopic metal particle in the separator can slowly work through the material over months or years, eventually creating a direct path between electrodes. Internal shorts are particularly dangerous because they can initiate thermal runaway without external warning.

The warranty specifications on residential batteries reflect these failure modes. A typical 10-year warranty guaranteeing 70% capacity retention assumes moderate cycling (one cycle per day), reasonable temperatures (10-35°C), and proper charging protocols. Operating outside these parameters accelerates aging, potentially voiding warranty coverage and reducing actual lifespan to half the warranted period.

Inverter Selection: The Underappreciated Choice

Installers spend hours helping customers choose battery capacity while glossing over inverter selection. This prioritization inverts the actual importance. Battery capacity can usually be expanded later; inverter choice locks in system architecture.

Hybrid inverters combine solar MPPT input, battery port, and grid-tie output in one box. SolarEdge Energy Hub, Enphase IQ8 system, and Tesla's integrated approach all fall in this category. The advantage is simplified installation, meaning one device, one commissioning procedure, unified monitoring. The disadvantage is inflexibility. Adding battery capacity beyond what the hybrid inverter supports requires either replacing the inverter or adding a second parallel unit.

AC-coupled battery inverters operate independently from solar. The SMA Sunny Boy Storage, Victron MultiPlus-II, and various Schneider Electric products serve this market. AC coupling allows adding batteries to any existing solar installation regardless of solar inverter brand. The efficiency penalty (two additional conversion stages) amounts to 6-8% round-trip loss compared to DC coupling.

For new construction with no existing solar, hybrid inverters make sense. The SolarEdge Energy Hub 10kW paired with their 400R optimizers and a BYD Battery-Box Premium handles most residential situations. The alternative, with separate SolarEdge solar inverter plus Victron storage inverter, costs more, requires more installation time, and introduces inter-device communication complexity.

For retrofits onto existing solar systems, AC coupling usually wins despite the efficiency penalty. Replacing a functional 5-year-old solar inverter to enable DC coupling rarely makes economic sense.

Site Assessment: What Actually Matters

Thermal Environment

Battery degradation accelerates exponentially with temperature. The Arrhenius relationship puts the acceleration factor around 2× per 10°C. A battery operating at 35°C average temperature loses capacity twice as fast as an identical unit at 25°C.

Garage installations in hot climates deserve scrutiny. Phoenix garages routinely exceed 45°C in summer. Las Vegas, Sacramento, and Austin present similar challenges. Manufacturers specify operating ranges, but the specified maximum (typically 45-50°C) represents a survival threshold, not an optimal condition.

The Tesla Powerwall includes active liquid cooling precisely because Tesla anticipated garage installations in hot markets. The Enphase IQ Battery relies on passive cooling and explicitly warns against installations where ambient temperature exceeds 45°C. The Powerwall handles Phoenix; the Enphase handles Portland. Installers who ignore this distinction generate warranty claims.

Cold temperature affects charging more than discharging. Below 0°C, lithium plating becomes a serious concern during charging. The Powerwall prohibits charging below -20°C and limits charge rate below 0°C. Products without active thermal management may lack the heating capability to charge during cold snaps, leaving the battery unable to accept solar production on winter mornings.

Structural Requirements

A fully loaded battery cabinet weighs more than most homeowners expect. The Tesla Powerwall 3 weighs 287 lbs (130 kg). The Enphase IQ Battery 5P weighs 27 lbs per microinverter plus 177 lbs for the enclosure with three battery units, roughly 230 lbs total for a typical installation.

Wall-mounting a 287-lb device requires hitting studs, using appropriate lag bolts, and in some cases adding backing material. Many installation manuals specify 2x6 backing plywood spanning at least three studs. Drywall alone, or even drywall over 2x4 studs at 24" centers, may not provide adequate support.

Floor-standing installations avoid the mounting strength question but introduce footprint concerns. The Generac PWRcell system with three battery modules occupies roughly 5 square feet of floor space. In cramped utility rooms, this footprint competes with HVAC equipment, water heaters, and electrical panels.

Electrical Infrastructure Assessment

The existing electrical panel determines installation complexity more than any other factor.

Panels manufactured before 1990 present problems. Federal Pacific and Zinsco panels have documented histories of breaker failures and are rejected by most storage manufacturers' installation requirements. Pushmatic and Bryant panels used obsolete breaker form factors that limit compatibility with modern bypass solutions. Any of these situations means panel replacement before battery installation, adding $2,000-4,000 and a separate permit to the project.

Panel bus rating matters for back-fed installations. Most residential storage inverters connect to the panel as back-fed breakers, sharing the bus with the main breaker. NEC 705.12(B)(2)(3), known as the "120% rule",:limits the sum of main breaker and back-fed breaker ratings to 120% of bus rating. A 200A panel with 200A main breaker can back-feed a maximum of 40A (120% × 200A - 200A = 40A). A 5kW inverter at 240V needs about 25A, fitting within this limit. A 10kW inverter at 240V needs about 50A, exceeding the limit.

Exceeding the 120% rule requires either upgrading to a larger panel, installing a supply-side (line-side) tap ahead of the main breaker, or installing a meter-main combo with integrated solar/storage provisions. Supply-side taps require utility approval and meter adapter equipment like the Enphase IQ System Controller or span-style meter-main combo panels.

The Permit Process: Regional Variation

Utility Interconnection

Utility interconnection requirements vary so dramatically by region that national-level advice becomes almost meaningless.

California's Rule 21 standardized the interconnection process and timeline across investor-owned utilities. PG&E, SCE, and SDG&E must respond to interconnection applications within 30 business days and complete Permission to Operate within 5 days of receiving final documentation. Net metering under NEM 3.0 (effective April 2023) altered the economics of storage dramatically by reducing export compensation to wholesale-adjacent rates, making self-consumption storage economically necessary for new solar installations.

Hawaii's experience prefigured California's. HECO moved to self-supply and time-of-use export rates years before California, making Hawaii the proving ground for residential storage business models. Installers who learned the business in Hawaii often understand storage economics better than mainland counterparts.

Texas presents a patchwork. ERCOT's deregulated market means no standardized interconnection process exists. Municipal utilities like Austin Energy and CPS Energy (San Antonio) have their own requirements. Some Texas co-ops still lack any battery interconnection pathway.

Florida utilities historically fought residential storage, particularly FPL (Florida Power & Light). Recent legislation and regulatory changes have forced more accommodating positions, but the interconnection process remains slower than in California or Arizona.

Building Department Permits

Building permit requirements also vary by jurisdiction. California's SolarAPP+ system enables automated permit approval for standard residential solar-plus-storage systems meeting specific criteria. Jurisdictions using SolarAPP+ issue permits within hours rather than weeks.

Outside California, permit timelines range from same-day approval in progressive jurisdictions to 6-8 weeks in understaffed counties. Fire department review adds time in jurisdictions that require separate fire approval, common in California counties and increasing elsewhere following several storage fire incidents.

The specific documentation required shifts between jurisdictions. Common requirements include:

- Single-line electrical diagram showing all system components

- Load calculations demonstrating panel capacity

- Site plan showing equipment locations with clearances

- Specification sheets for all major equipment

- Structural attachment details for wall-mounted equipment

Installation Execution

Before Touching Anything

The pre-installation checklist prevents expensive mistakes:

Confirm equipment compatibility in writing. Just because products appear compatible in marketing materials does not mean they work together. The SolarEdge Energy Hub requires specific BYD battery models, meaning not all BYD products, only the Battery-Box Premium HVM and HVS series. The previous-generation SolarEdge StorEdge worked with LG Chem RESU, which the Energy Hub does not support. Verify compatibility by cross-referencing manufacturer compatibility lists, not by assuming product line continuity.

Verify firmware versions match requirements. Storage systems combine components from multiple manufacturers, each with their own firmware. BYD batteries have firmware. SolarEdge inverters have firmware. The BMS has firmware. Communication modules have firmware. Incompatible firmware versions cause mysterious failures that waste hours to diagnose. Update all components to current firmware before attempting commissioning.

Test ground fault detection before installation. Modern storage inverters include ground fault detection that will refuse to operate if any ground fault exists on the site electrical system. Old homes with degraded wiring insulation or bootleg grounds may fail this test, requiring wiring repairs before storage installation can proceed.

Mounting Considerations That Matter

The installation manual specifies mounting requirements. Ignoring them creates problems that manifest months later.

Wall mounting height affects both serviceability and thermal performance. Most manufacturers specify a minimum height above floor level for the bottom of the unit (typically 12-18 inches) and maximum height for the top (typically 6 feet). These specifications exist for practical reasons: too low invites water damage from floor washing or minor flooding; too high makes service access difficult and may place the unit in a warmer air layer near ceiling level.

Structural backing requirements vary by unit weight. The Tesla Powerwall 3 at 287 lbs requires mounting into structural members (studs or concrete) with lag bolts meeting specified pull-out strength. BYD Battery-Box requires similar structural support. The installation manuals specify minimum wood member dimensions, bolt sizes, and in some cases, require plywood backing plates spanning multiple studs.

Installers who mount heavy batteries on drywall alone, even with toggle bolts, create time bombs. The unit may hold for months, then shift during a minor seismic event or thermal expansion cycle, damaging internal connections or pulling free entirely.

Clearance requirements serve multiple purposes. Front clearance (typically 36 inches) enables service access with the enclosure open. Side and top clearance (typically 6-12 inches) allows airflow for units using passive cooling. Rear clearance prevents moisture accumulation between the unit and wall surface.

Cramming a battery into a tight corner to save space violates clearance requirements and creates service problems. The installer saves 30 minutes during initial installation and costs 2 hours on every future service call.

DC Wiring: Where Mistakes Cost Money

Battery-to-inverter DC wiring carries high current at relatively low voltage. A 10kW system at 48V battery voltage draws over 200A at full power. This current level demands respect.

Wire sizing must satisfy both ampacity and voltage drop. The ampacity table in NEC 310.16 specifies current capacity based on conductor size and installation conditions. But meeting ampacity alone may still result in unacceptable voltage drop.

For a 10-foot run at 200A on 48V nominal:

- 4/0 AWG copper: voltage drop = 2 × 200A × 10ft × 0.0000508 Ω/ft = 0.20V (0.4%)

- 2/0 AWG copper: voltage drop = 2 × 200A × 10ft × 0.0000808 Ω/ft = 0.32V (0.7%)

- 1/0 AWG copper: voltage drop = 2 × 200A × 10ft × 0.000102 Ω/ft = 0.41V (0.9%)

These drops seem trivial on a 48V system, but they represent continuous power loss. At 200A continuous, 0.2V drop dissipates 40W, which is not enough to start a fire but enough to heat the cable noticeably and waste energy over years of operation.

More critically, low-voltage battery systems have tighter voltage margins than grid-tied solar. A battery that operates from 42V (discharged) to 58V (full) must work with inverters that have similar operating windows. Excessive voltage drop can push the inverter-side voltage below operating thresholds even while the battery-side voltage remains acceptable.

Use the largest practical conductor for DC runs. The incremental cost of 4/0 over 2/0 for a 20-foot run amounts to maybe $50 in copper, trivial against total system cost. The smaller conductor saves $50 upfront and costs $100 in wasted energy over the system lifetime.

Terminal Connections: The Failure Point

More storage system failures trace to poor connections than to any other cause. The connection between cable and terminal, and between terminal and equipment, must withstand decades of thermal cycling and current flow.

Compression terminals (crimp lugs) require proper tooling. A hydraulic crimping tool applying specified tonnage creates a gas-tight cold weld between terminal and conductor. Hand-squeezed crimpers and undersized tools create connections that look adequate but develop resistance over time.

Mechanical terminals (bolted lugs) require torque specification compliance. Under-torqued connections have inadequate contact pressure; over-torqued connections crush conductor strands and crack terminal barrels. Every equipment manual specifies torque values. Ignoring these specifications guarantees callbacks.

The anti-oxidant compound argument divides installers. Some insist on applying oxide-inhibiting compound to every copper-copper connection. Others consider this overkill given copper's relative stability compared to aluminum. For residential storage, the conservative approach, such as applying compound to all power connections, costs maybe $10 in materials and eliminates one failure mode.

Commissioning: The Part Installers Rush

After the physical installation, commissioning transforms inert equipment into a functioning system. Rushing commissioning creates problems that manifest weeks or months later as customer callbacks.

Insulation resistance testing catches wiring damage before energization. Using a 500V or 1000V megohmmeter, test between each conductor and ground. Acceptable readings exceed 1 MΩ. Lower readings indicate insulation damage, contamination, or wiring errors that require correction before energizing.

The test procedure matters. Disconnect all electronic equipment before applying megohmmeter voltage. The 500-1000V test signal will damage sensitive electronics. For battery systems, this means opening the battery disconnect before testing the DC wiring between battery and inverter.

Polarity verification prevents immediate equipment damage. DC polarity errors can destroy inverter input stages in milliseconds. Verify with a multimeter before closing any DC disconnect. Check both that the battery terminals have correct polarity and that the wiring maintains that polarity through to the inverter terminals. A single wire swap anywhere in the DC path creates reverse polarity.

Communication verification confirms all system components talk to each other. Battery BMS, inverter, and monitoring equipment must establish communication before the system operates correctly. For SolarEdge systems, this means verifying SetApp connectivity and completing system configuration. For Enphase, this means confirming Envoy detection of all IQ Batteries.

Communication failures cause the most troubleshooting time during commissioning. The CAN bus or RS-485 connection between battery and inverter requires correct termination resistors, proper cable construction, and matched protocol settings. An improperly terminated communication bus may work initially, then fail intermittently as temperature changes alter signal characteristics.

Protection function testing confirms the system will disconnect under fault conditions. Simulate a ground fault (if safe testing procedure exists) and verify the inverter trips. Verify anti-islanding by disconnecting grid at the main breaker and confirming inverter shutdown within 2 seconds.

Anti-islanding verification is particularly important because failure means the battery could energize a dead grid during outages, creating lethal hazard for utility workers. Every jurisdiction requires anti-islanding, and every commissioning should verify it functions.

Grid synchronization testing verifies proper parallel operation. With the system running in grid-tied mode, measure voltage and frequency at the inverter output and compare to grid values. Any deviation exceeding manufacturer specifications indicates a problem.

Backup transfer testing confirms the system provides power during outages. With loads connected to the protected panel, open the main breaker to simulate grid loss. The system should transfer to backup within the specified time (typically under 20 milliseconds for systems with automatic transfer). Observe that loads continue operating through the transfer. Close the main breaker and verify the system resumes grid-tied operation.

During backup transfer testing, note the actual transfer time using an oscilloscope or power quality meter if available. Systems that advertise 20ms transfer but actually transfer in 200ms will lose computer data and trip sensitive equipment. The commissioning test reveals actual performance versus specification.

Parameter configuration tailors system behavior to the installation. Key parameters include:

- Backup reserve percentage (how much capacity to hold for outages)

- Export limit (how much power to feed back to grid, may be limited by utility agreement)

- Time-of-use schedule (when to charge versus discharge based on rate schedule)

- Charge rate limits (may need reduction if site electrical service is limited)

Incorrect parameter configuration causes customer complaints about unexpected behavior. A system configured for California TOU rates installed in Texas with different rate structure will make poor economic decisions. A backup reserve set to 0% provides no protection during outages. Getting these parameters right during commissioning prevents callbacks.

Living With the System

What Actually Needs Monitoring

Battery monitoring systems generate enormous amounts of data. Most of it does not matter for routine operation. The metrics worth watching:

State of health trend over time. Most systems report SOH as a percentage of original capacity. New batteries start at 100% or near it. Declining below 90% within the first three years suggests a problem, indicating either operating conditions outside specifications or a defective battery. Warranty claims against premature capacity loss require documented SOH history.

Cell voltage spread at end of charge. Individual cell voltages should converge at full charge. If one cell reaches 3.65V while others remain at 3.55V, the pack has a balance problem. Small spreads (under 0.05V) are normal and self-correcting. Spreads exceeding 0.1V warrant investigation.

Round-trip efficiency over time. Divide energy out by energy in over weekly or monthly periods. New systems achieve 88-92% round-trip efficiency depending on configuration. Efficiency declining below 80% indicates either increased battery resistance (aging) or inverter problems.

Charge and discharge power versus specifications. A system rated for 5kW continuous should deliver 5kW when called upon. If observed power plateaus at 4kW despite load demand, something limits output, possibly temperature derating, possibly BMS restriction, possibly inverter fault.

When to Call a Professional

Battery systems fail in ways that homeowners cannot diagnose or repair. Certain symptoms demand professional attention:

Communication faults that persist after power cycling. Rebooting clears transient faults. Persistent communication loss between battery and inverter indicates hardware failure, configuration corruption, or wiring damage.

Any fault code mentioning "ground fault," "isolation fault," or similar. These codes indicate current flowing through unintended paths. Ignoring them risks equipment damage or fire. Do not reset the system and continue operating.

Thermal warnings or evidence of overheating. Discoloration around connections, burning smell, or visible damage requires immediate shutdown and inspection. Do not attempt to operate equipment that has overheated.

Capacity loss exceeding 10% per year. Normal aging produces 2-3% annual capacity loss in properly operated LFP systems. Faster decline indicates either abuse (deep cycling at temperature extremes) or cell defects. Either situation warrants manufacturer involvement for warranty evaluation.

Long-Term Maintenance: What the Warranty Requires

Battery warranties contain maintenance requirements that owners often overlook. Failure to perform required maintenance can void warranty coverage.

Annual professional inspection: Many manufacturers require annual inspection by a certified technician. Tesla requires annual Powerwall inspections for commercial installations and recommends them for residential. The inspection typically covers:

- Visual examination for physical damage, corrosion, or pest intrusion

- Thermal imaging of electrical connections under load

- Verification of communication and monitoring function

- Firmware update to current release

- Functional test of backup transfer operation

- Documentation of system health metrics for warranty records

The inspection cost runs $150-300 depending on location and installer. Skipping inspections saves money short-term but creates warranty risk if problems develop.

Firmware maintenance: Manufacturers release firmware updates addressing bugs, adding features, and improving performance. Some updates are mandatory for continued warranty coverage. Owners who ignore update notifications may find their warranty claims denied due to running obsolete firmware.

Most modern systems support over-the-air updates, but some require technician visits. The Tesla Powerwall updates automatically over WiFi. Enphase systems update through the Envoy monitoring gateway. SolarEdge systems may require technician intervention for major updates.

Environmental maintenance: The installation space requires periodic attention:

- Keep vegetation cleared from outdoor installations

- Maintain ventilation paths free of obstructions

- Clean or replace air filters on units with active filtration

- Address any water intrusion promptly

- Control temperature extremes through insulation, ventilation, or HVAC if necessary

Documentation maintenance: Keep records of:

- Original installation documentation and permits

- Annual inspection reports

- Any service visits and repairs

- Monthly or quarterly performance data exports

- Communication with manufacturer regarding any issues

Complete documentation supports warranty claims and provides value at property sale. A well-documented battery system transfers smoothly to new owners; an undocumented system raises questions and reduces sale value.

The Cost Reality

What a Turnkey Installation Actually Costs

Published battery prices mislead by excluding installation costs that typically equal or exceed equipment costs.

For a 13.5 kWh Tesla Powerwall 3 system in California (2024-2025 pricing):

- Equipment: $9,500 (Powerwall 3 + Gateway)

- Installation labor: $3,000-5,000

- Electrical materials: $500-1,500

- Permit fees: $300-800

- Utility interconnection fees: $0-500

- Total installed: $13,300-17,300

For a 15 kWh Enphase IQ Battery system:

- Equipment: $12,000-14,000 (5 × IQ Battery 5P + IQ System Controller)

- Installation labor: $2,500-4,500 (often faster than Powerwall due to AC coupling simplicity)

- Electrical materials: $400-1,200

- Permit fees: $300-800

- Total installed: $15,200-20,500

The federal Investment Tax Credit reduces effective cost by 30% when claimed on tax returns. A $15,000 installed system costs $10,500 after ITC.

State incentives vary. California's SGIP (Self-Generation Incentive Program) provides additional rebates for storage, though funding availability fluctuates. Oregon's Solar + Storage rebate program offers up to $5,000 for storage. Massachusetts and other states have their own programs.

The Tool Investment Nobody Mentions

Professional storage installation requires tools beyond standard electrician kits. The investment separates serious installers from pretenders.

Crimping equipment: Battery terminals at 4/0 AWG require hydraulic crimping tools. A Burndy Y35 or equivalent runs $600-900. Hand crimpers cannot achieve the 12-ton force needed for reliable 4/0 crimps. Installers using inadequate crimping tools create connections that pass initial inspection but fail within two years.

Torque tools: Battery and inverter terminals specify torque values ranging from 8 Nm to 45 Nm depending on terminal size. A quality torque wrench covering this range costs $150-300. A torque screwdriver for smaller fasteners adds another $100. Many installers skip torque verification, producing callbacks when connections loosen.

Insulation testing: A 1000V megohmmeter (Fluke 1507 or equivalent) costs $500-700. This tool catches insulation damage before energization. Installers who skip insulation testing occasionally energize systems with pinched conductors, producing immediate failures or slow-developing faults.

Thermal imaging: An infrared camera capable of detecting connection hot spots costs $300-500 for basic models (FLIR ONE Pro) to $3,000+ for professional units. Annual thermal scans of operating connections catch degrading connections before they fail.

The tool investment for a properly equipped storage installation crew exceeds $3,000. This investment separates companies that execute reliable installations from those producing a steady stream of service calls.

When Storage Makes Economic Sense

Storage economics depend entirely on local utility rate structures.

Strong economics:

- Time-of-use rates with >$0.15/kWh peak-to-off-peak differential

- High demand charges for residential customers

- Poor net metering compensation (California NEM 3.0, Hawaii)

- Frequent grid outages creating meaningful backup value

Weak economics:

- Flat-rate electricity pricing

- Generous net metering at retail rates

- Stable grid with rare outages

- Very low electric rates (<$0.10/kWh)

For a California household on PG&E's E-TOU-C rate schedule, the peak-to-off-peak differential reaches $0.30/kWh or more. Arbitraging 10 kWh daily at this rate yields $3.00/day or roughly $1,000/year. Combined with self-consumption value from a solar system, storage pays back in 7-10 years, reasonable given 15+ year expected life.

For a household in the Pacific Northwest on flat-rate $0.09/kWh electricity with favorable net metering, storage offers only backup value. If backup alone is worth $1,000-2,000 to the household, a $15,000 system never achieves economic payback. The purchase becomes a reliability investment rather than an economic one.

The NEM 3.0 effect:

California's Net Energy Metering 3.0 tariff, effective April 2023, fundamentally changed residential solar economics in the state. Under NEM 3.0, excess solar energy exported to the grid earns only $0.04-0.08/kWh depending on time of day, versus the $0.30-0.50/kWh retail rate for purchased electricity.

This export/retail rate differential means every kWh stored for self-consumption instead of exported captures $0.25-0.45 in value. A 13.5 kWh battery cycling daily under NEM 3.0 captures $3-6/day in self-consumption value, roughly $1,000-2,000/year. This value stream alone justifies battery investment for California solar owners.

Before NEM 3.0, California solar owners could export freely at retail rates, making batteries economically marginal except for backup value. NEM 3.0 inverted the calculus: new solar installations in California now almost always include battery storage because the export penalty makes storage economically compelling.

Hawaii reached this inflection point earlier. HECO's self-supply rates have favored storage for years, making Hawaii the testing ground for storage-centric solar system design. California installers who studied Hawaii's market understood NEM 3.0's implications before mainland competitors caught up.

Demand charge economics:

Some utilities apply demand charges to residential customers, billing based on peak power draw in addition to total energy consumption. A household hitting 15 kW peak demand might pay $10-15/kW/month in demand charges, adding $150-225 to monthly bills.

Battery systems can reduce demand charges by limiting grid draw during peak demand periods. The battery supplements grid power when household demand spikes, keeping the metered peak lower. This "peak shaving" application generates savings independent of TOU arbitrage or self-consumption value.

Demand charge savings are highly site-specific. A household with steady loads and no demand spikes gains nothing. A household with large air conditioning, electric vehicle charging, or electric heating loads that spike demand sees significant savings. Modeling specific load profiles is necessary to project demand charge benefits.

Resale value considerations:

Battery storage affects property value, though quantifying the effect remains imprecise. Real estate agents report that solar-plus-storage systems command premiums in markets with high electricity costs and frequent outages (California, Texas, Florida). In markets with low electricity costs and stable grids, the premium is smaller or nonexistent.

A fully paid, well-documented battery system transfers smoothly to new owners. A leased system or one with outstanding financing complicates transactions. Sellers should consider ownership structure when purchasing storage.

Systems older than 10 years may actually reduce sale value if buyers perceive imminent replacement cost. A 2015 Powerwall 1 at the end of its warranty period adds less value than a 2022 Powerwall 3 with years of warranty remaining.

What the Guides Leave Out

The Brand Reality

Installer forums reveal reliability patterns that marketing materials obscure.

The Tesla Powerwall accumulates the longest track record in the current market generation. First-generation Powerwall 1 units from 2015-2016 showed thermal management weaknesses that later generations resolved. Powerwall 2 and Powerwall+ demonstrated strong field reliability. Powerwall 3, released in 2024, lacks long-term data but continues Tesla's integrated-system approach.

Enphase IQ Battery entered the market as a modular alternative to Tesla's monolithic approach. Field reports through 2023-2024 show good reliability but some commissioning difficulties related to Envoy communication. Enphase's microinverter-per-battery architecture distributes failure risk, meaning one battery module failing does not take down the entire system.

The BYD Battery-Box Premium, when paired with compatible inverters, shows excellent field reliability and the longest cycle life ratings in the residential segment (6,000+ cycles to 80% capacity per BYD specifications). The BYD-specific BMS requires compatible inverters, and attempting to pair with unsupported inverters causes communication failures.

Franklin WholePower (formerly FranklinWH) emerged as an alternative targeting whole-home backup applications. The integrated aPower hardware combines battery, inverter, and gateway functions. Field track record remains limited given market entry timing.

The Skills Gap

The residential storage installation workforce cannot meet demand. Solar installers who spent years mastering panel layout and string sizing suddenly confront battery chemistry, inverter configuration, and grid-forming operation modes. The learning curve is steep.

Manufacturer certification programs help but vary in rigor. Tesla requires Powerwall Certified Installer status, which involves online training, exam completion, and insurance verification. Enphase similarly certifies installers through training programs. These programs teach product-specific installation but may not cover electrical fundamentals that some installers lack.

Installation failure cases from contractor forums illustrate the knowledge gaps:

A Phoenix installer mounted a Powerwall on a south-facing exterior wall in direct afternoon sun. The unit thermal-throttled every summer afternoon, delivering half its rated capacity during peak demand hours. Tesla replaced the unit under warranty, but the underlying installation problem persisted until the homeowner paid separately for relocation to a shaded north wall.

A Florida company installed an Enphase system without properly configuring the System Controller for backup operation. The system worked for grid-tied operation. When Hurricane Ian hit, the backup function failed to activate. The homeowner discovered the configuration error while sitting in darkness with a $20,000 battery system that could not power a light bulb.

A California installer connected a BYD battery to an unsupported inverter, ignoring BYD's published compatibility list. Initial operation appeared normal. Communication faults developed within months. Both manufacturers denied warranty claims, citing the incompatible pairing. The homeowner spent 18 months in dispute resolution.

A Colorado installer used undersized crimping tools on 4/0 battery cables. The connections passed visual inspection. Six months later, thermal imaging during a service call revealed one terminal running 45°C above ambient. The connection had developed enough resistance to waste 200W continuously and posed a fire risk.

These cases share a pattern: equipment that worked correctly, installations that did not.

Customers benefit from asking pointed questions before hiring:

- How many storage systems has this company installed?

- What percentage of installations achieve Permission to Operate within 30 days?

- What is the callback rate within the first year?

- Who performs warranty service, the installing company or a third party?

The installer market includes both excellent craftspeople who invested years learning storage systems and solar companies that added "battery installation" to their service list without developing real competence. Distinguishing between them requires asking for references and verifying them.

The Grid Interaction Question

Residential batteries interact with the grid in ways that neither homeowners nor many installers fully understand.

All grid-tied storage inverters include anti-islanding protection, automatic disconnection when grid power fails. Without anti-islanding, a battery system could back-feed a dead grid, energizing distribution lines that utility workers assume are de-energized. This protection is mandatory and typically tested during commissioning.

Grid-forming capability allows a storage system to create its own AC voltage reference during outages, operating independently of the grid. Not all storage inverters support grid-forming operation. Systems without grid-forming capability cannot provide backup power even with functional batteries.

The Tesla Powerwall includes grid-forming capability as a standard feature. Each Powerwall can operate independently during outages, creating 120/240V split-phase power for household circuits.

Enphase IQ Battery systems require the IQ System Controller for backup operation. The System Controller provides the grid-forming function; the batteries alone cannot operate during outages without it.

SolarEdge Energy Hub includes backup capability but requires additional hardware (Backup Interface module) for automatic transfer to backup mode.

This architectural variation confuses customers who assume all battery systems provide backup power. A battery system without grid-forming capability or transfer switching hardware provides economic benefits during normal operation but goes dark during outages just like a home without batteries.

What Happens During an Outage

Backup operation differs from grid-tied operation in ways that affect daily use.

During grid outages, the storage system shifts from grid-following to grid-forming mode. The inverter creates its own voltage and frequency reference rather than synchronizing to grid voltage. This transition requires transfer switch operation, either automatic (built into systems like Powerwall) or manual (requiring homeowner action).

Load management during backup becomes critical. A battery system sized for daily cycling may support full household loads when the grid is available but cannot sustain those loads during extended outages. A 13.5 kWh battery supporting 5 kW continuous load depletes in under three hours. The same battery supporting 1.5 kW critical loads (refrigeration, lighting, network equipment) lasts nine hours.

Intelligent load management panels like the Span Smart Panel enable circuit-level control during outages. Non-critical circuits (electric vehicle charging, electric water heating, HVAC) can be automatically shed during backup operation, preserving battery capacity for critical loads. This capability extends backup duration dramatically without increasing battery capacity.

Solar production during outages requires specific system configuration. Not all configurations allow solar to charge batteries during outages. The system must support "solar self-consumption" mode in island operation. Tesla Powerwall supports this. Enphase IQ systems support it with proper configuration. Some AC-coupled configurations do not support it, preventing solar production during extended outages.

Extended outage scenarios:

Multi-day outages stress battery systems beyond daily cycling assumptions. After Hurricane Maria in Puerto Rico, some Powerwall owners ran for weeks on solar and battery alone. These extreme scenarios reveal system limitations:

Solar production varies with weather. Cloud cover during an outage dramatically reduces recharge capability. A system that comfortably sustains critical loads during sunny conditions may fail during overcast periods.

Battery efficiency degrades under continuous cycling. A system cycled once daily at 50% depth of discharge performs differently than one cycled three times daily at 90% depth. Continuous heavy use accelerates internal resistance growth and heating.

Refrigerator and freezer contents require temperature maintenance even when the household is evacuated. Running the battery down to protect frozen food, then departing, may leave nothing for the homeowner's return.

Medical equipment presents special considerations. CPAP machines, oxygen concentrators, and other life-support equipment require uninterrupted power. Systems protecting medical loads should be sized with extra margin and configured to prioritize those circuits absolutely.

What the monitoring app shows during outages:

Most storage systems provide mobile app monitoring that continues during outages (assuming cellular or WiFi connectivity persists). The app typically displays:

- Current power draw and battery depletion rate

- Estimated remaining runtime at current consumption

- Solar production (if applicable)

- Individual circuit consumption (on systems with circuit-level monitoring)

- Warnings about overload conditions or low battery state

Homeowners who learn to read this information during normal operation can manage loads intelligently during outages, extending backup duration by making informed decisions about which loads to run and when.

Generator interaction:

Some homeowners want battery backup supplemented by a generator for extended outages. This combination requires careful design. The battery system and generator must coordinate to avoid simultaneous backfeed and to transition smoothly between power sources.

The Tesla Powerwall integrates with generators through the Backup Gateway, which can start a compatible generator when battery state of charge falls below a threshold. The generator charges the battery; the battery powers the house. This approach avoids running the generator continuously and reduces noise and fuel consumption.

Other systems require manual generator management. The homeowner must turn off the battery backup, switch transfer switches to generator position, then start the generator. This manual process works but requires presence and attention during outage events.

Portable generators connected through inlet boxes must not be connected while the battery system is operating in backup mode. The battery inverter and generator would fight for voltage and frequency control, potentially damaging both devices.

Conclusion

Installing a household battery correctly requires knowledge spanning electrochemistry, power electronics, electrical codes, and utility interconnection policy. The stakes include fire safety, equipment longevity, and economic return on a significant investment.

The products available in 2024-2025 have matured beyond the early-adopter phase. Tesla, Enphase, and BYD have shipped enough units that their reliability patterns are observable. LFP chemistry has proven its safety advantages. Hybrid inverters have reduced installation complexity for new construction.

Finding an installer who combines electrical skill, storage-specific training, and attention to detail remains difficult in most markets. Utility interconnection timelines remain unpredictable outside California's standardized process.

The technology trajectory:

Battery costs continue declining. Cells that cost $150/kWh at the pack level in 2020 cost $100/kWh in 2024. Industry projections suggest $70-80/kWh by 2027. This cost decline makes storage economically viable in progressively more markets.

Sodium-ion batteries may enter the residential market by 2026-2027. Contemporary Amperex Technology (CATL) and BYD both have sodium-ion products in development. Sodium-ion avoids the lithium supply constraints and geopolitical concerns associated with lithium-ion, though energy density is 10-20% lower. For stationary residential storage where space is less constrained than in vehicles, sodium-ion may offer cost advantages.

Solid-state batteries remain further out. Despite heavy investment and frequent announcements, solid-state technology is not commercially viable for residential storage in any current timeline. The technology may eventually offer higher energy density and improved safety, but residential storage does not require the energy density improvements that drive solid-state development for vehicles.

Vehicle-to-home (V2H) capability is arriving in some electric vehicles. The Ford F-150 Lightning, Hyundai Ioniq 5, and certain Rivian models support bidirectional charging that can power homes during outages. As EV adoption grows, some households may find V2H adequate for backup power without dedicated stationary storage. The economic case for stationary storage then shifts to daily TOU arbitrage, which V2H cannot serve while the vehicle is away from home during peak rate hours.

The installation quality problem:

The industry's central challenge is not technology but execution. Battery technology works well when installed correctly. Installation failures result from inadequate training, rushed work, and insufficient attention to manufacturer requirements.

The bottleneck is human capital. Training an electrician to install storage safely takes months of structured learning and supervised practice. The industry has grown faster than training capacity, producing a workforce with uneven competence. Some installers execute at professional standards; others produce work that will fail.

The solution for homeowners is diligence: verify installer credentials, check references, observe the work in progress, and insist on complete documentation. The solution for the industry is investment in training infrastructure that matches the pace of market growth.

For homeowners considering storage, the decision framework reduces to three questions: Do local utility rates create meaningful arbitrage value? Is backup power worth a premium? And most importantly, is a competent installer available in the local market?

The technology works. The economics work in favorable rate environments. The remaining variable is execution quality; that depends on the specific installer doing the work.

Sources Referenced

LG Chem Battery Recall:

- ACCC Media Release: "LG undertakes to take more steps to locate and fix dangerous solar batteries" (May 26, 2024)

https://www.accc.gov.au/media-release/lg-undertakes-to-take-more-steps-to-locate-and-fix-dangerous-solar-batteries - ACCC Product Safety: "ESS Home Energy Storage System Batteries"

https://www.productsafety.gov.au/recalls/lg-energy-solution-australia-pty-ltd-formerly-lg-chem-australia-pty-ltd-ess-home-energy-storage-system-batteries - Energy-Storage.News: "Fire risk recall for LG home battery storage equipment owners in Australia" (May 24, 2022)

https://www.energy-storage.news/fire-risk-recall-for-lg-home-battery-storage-equipment-owners-in-australia/

Sanbornton, NH Battery Fire:

- Laconia Daily Sun: "Lithium ion battery causes house fire in Sanbornton Saturday" (December 22, 2022)

https://www.laconiadailysun.com/news/local/lithium-ion-battery-causes-house-fire-in-sanbornton-saturday/article_c8b6f086-817a-11ed-830d-0357cd68cf09.html - Concord Monitor: "House damaged in fire from used batteries providing home power backup" (December 21, 2022)

https://www.concordmonitor.com/battery-fire-sanbornton-nh-49277924

General Battery Safety:

- U.S. Department of Energy: "A Guide to Fire Safety with Solar Systems"

https://www.energy.gov/eere/solar/guide-fire-safety-solar-systems