Most residential buyers pay between $12,000 and $16,000 for a solar battery bank after everything gets installed and connected. The 30% federal tax credit knocks that down to $8,400 to $11,200 out of pocket. Some people pay half that in states with generous rebate programs. Others pay nearly double in places where only a few installers operate and competition stays weak.

The price varies so much because batteries have become commodities while installation remains a craft. The cells inside a Tesla Powerwall come from the same Chinese factories that supply LG and most other brands. What differs is the markup, the labor market, and whether local governments make permitting easy or painful.

Where the Money Actually Goes

Battery hardware has gotten cheap. Shockingly cheap. The lithium iron phosphate cells that power most home batteries now cost manufacturers around $60 per kWh to produce. A 13.5 kWh battery pack contains maybe $800 worth of cells. Add the enclosure, wiring, battery management electronics, and thermal controls, and the manufacturer's cost for the complete unit might reach $2,500 to $3,500.

Yet that same battery sells to installers for $6,000 to $8,000, and homeowners pay $9,000 to $12,000 before installation labor even enters the picture.

home battery systems are compact and designed for residential garage or utility room installation

The gap between manufacturing cost and retail price funds an entire industry: Tesla's Gigafactory overhead, distributor warehouses, sales commissions, marketing budgets, warranty reserves, and profit margins at every step. None of this is illegitimate. Building and supporting a battery business costs money. But buyers should understand that when they comparison shop, they're mostly negotiating over how much margin each party captures rather than any fundamental difference in the product.

Installation labor adds another $2,000 to $5,000 depending on complexity and local wages. A garage wall mount with a short wire run to the electrical panel takes half a day for two electricians. Running conduit through a finished basement, upgrading an old panel, and coordinating a utility inspection can stretch to a week.

Permitting and utility interconnection pile on $500 to $2,000 more, sometimes much more in jurisdictions that treat every battery installation like a nuclear reactor licensing proceeding.

The practical reality: about 60% of the price goes to hardware, 25% to labor and installation, and 15% to permits, overhead, and margin. Buyers can negotiate the first two categories but have almost no control over the third.

The Brand Question

Battery shopping feels like it should matter enormously. Tesla versus Enphase versus LG versus Generac. Glossy spec sheets. Competing warranty claims. Online forums debating which battery will outlast the others.

Most of this energy gets wasted.

The cells inside competing batteries come from the same handful of Asian manufacturers. CATL, BYD, EVE Energy, and a few others supply nearly everyone. The chemistry has standardized around lithium iron phosphate for home storage because it costs less, lasts longer, and presents negligible fire risk compared to older formulations. When Tesla switched from nickel-based cells to LFP, the Powerwall became interchangeable at the cell level with competitors it had previously claimed to outperform.

What actually differs across brands: power output ratings, software quality, inverter integration, warranty terms, and the manufacturer's likelihood of existing in ten years.

Power output matters more than most buyers realize. A battery rated for 5 kW continuous output cannot start a central air conditioner. The compressor needs 4 to 7 kW just to get moving. Owners discover this during their first real outage when the battery trips offline trying to handle loads that fit comfortably within its stated capacity but exceed its instantaneous power limits. Tesla's Powerwall 3 addressed this with an 11.5 kW continuous rating. FranklinWH hits 10 kW. Most Enphase configurations top out around 7.5 kW. The spec sheets list these numbers, but salespeople rarely emphasize them because explaining the difference requires admitting that capacity and power are different things.

Software and integration determine daily experience. Tesla's app shows pretty graphs and enables grid services enrollment. Enphase integrates tightly with their microinverters but locks out third-party equipment. Generac's interface feels dated but their installer network knows how to troubleshoot it. These differences matter more for the first six months of ownership than over the subsequent fifteen years.

Warranty terms have converged toward ten years. Enphase offers fifteen. The practical value of a fifteen-year warranty depends on whether Enphase remains solvent and whether the warranty actually covers the failure mode that eventually occurs. Batteries mostly fail through gradual capacity loss rather than sudden death, and warranties typically guarantee only 60-70% capacity retention at the end of their term.

Manufacturer stability has become a legitimate concern. SunPower went bankrupt. Panasonic exited the market. LG has retreated from direct distribution. The battery business requires scale to survive, and not everyone has it. Tesla and Enphase will almost certainly exist in 2035. Smaller players carry more risk.

Brand Recommendations at a Glance

If forced to recommend a default choice for someone who wants to install a battery without becoming an expert: Tesla Powerwall 3. Not because the technology is superior, but because the company will exist, parts will remain available, and enough units have shipped that problems get identified and fixed quickly. At roughly $14,000 installed before incentives, the price sits mid-market and the performance covers most use cases adequately.

Households with Enphase microinverters already installed or planned should consider Enphase IQ batteries. The integration works smoothly and the fifteen-year warranty provides peace of mind despite the higher per-kWh cost.

Cost-focused shoppers find LG RESU systems attractive at 25-30% below Tesla pricing. The uncertain distribution situation means verifying warranty support before purchasing.

Backup power during outages matters most to some households. FranklinWH offers the highest power output ratings and the most complete whole-home backup capability, at a modest premium.

Beyond these four options, the value proposition becomes questionable. Sonnen charges luxury prices for similar technology. Off-brand imports offer savings that evaporate when something fails and support proves unavailable. The market has consolidated around a few defensible positions, and buyers outside those positions face elevated risk.

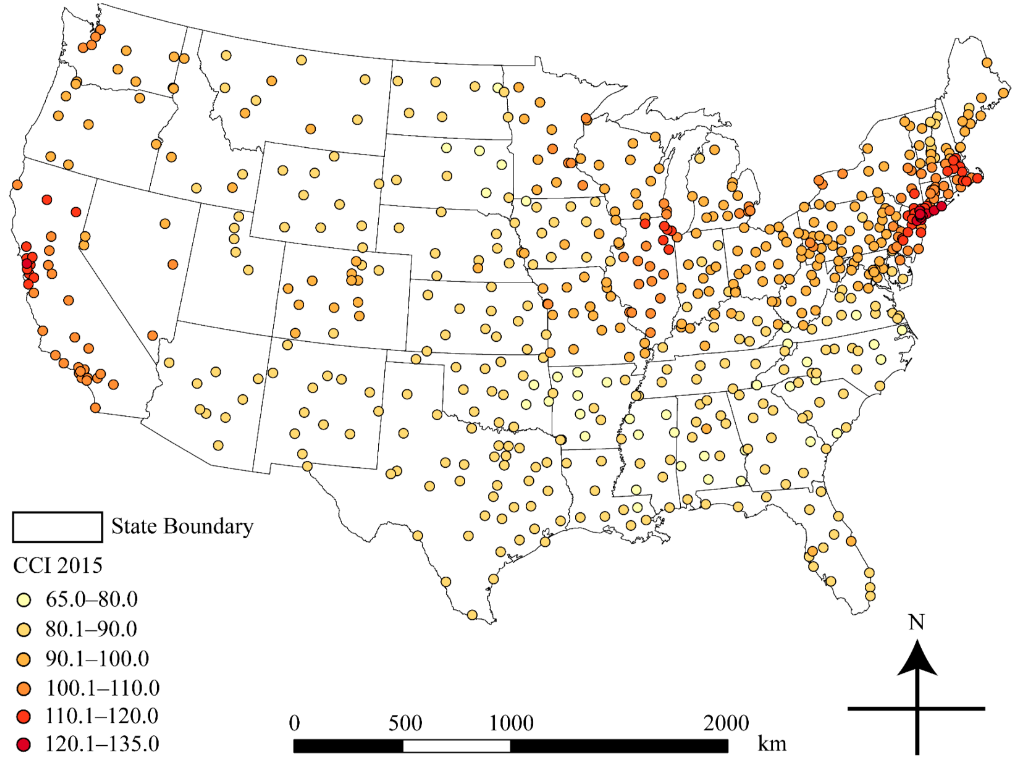

Geography Shapes Cost More Than Product Choice

A buyer in Phoenix and a buyer in Boston purchasing identical Tesla Powerwall systems will pay prices differing by $4,000 or more. The battery costs the same. Everything else varies.

Phoenix has abundant solar installers competing aggressively for market share. Permitting takes days. The utility interconnection process operates smoothly. Labor costs run lower than coastal averages. A Powerwall 3 installs for maybe $12,000.

Boston has fewer installers, many of them union shops with higher hourly rates. Permitting in older municipalities can require structural engineering assessments for wall-mounted equipment. Interconnection reviews stretch weeks or months. The same Powerwall costs $16,000 or more.

Geographic location significantly impacts both installation costs and available incentive programs

California occupies a strange middle position. Installation costs run high due to expensive labor and demanding inspections. Yet the state's Self-Generation Incentive Program can provide $1,500 to $10,000 in rebates depending on household income and location. A buyer in a fire-prone area who qualifies for the equity resiliency tier can receive enough rebate money to cover half or more of total system cost. A median-income buyer in a coastal city receives perhaps $1,500 and pays full freight for everything else.

Texas and Arizona offer low installation costs but minimal state incentives. The federal tax credit provides the only substantial subsidy. Net prices after incentives often match or exceed higher-cost states with better rebate programs.

The Northeast runs expensive for installation but offers layered incentive programs that require patience to navigate. Massachusetts pays homeowners for demand response participation. Connecticut provides upfront rebates plus ongoing performance payments that can total more than the battery cost over a decade. The programs have application requirements, capacity limits, and timing constraints. Buyers who successfully work through the bureaucracy access economics unavailable elsewhere. Those who give up face the region's high base prices without offsetting subsidies.

Hawaii represents the extreme case: the highest installation costs in the country paired with the strongest economic rationale for batteries. Electricity runs three times mainland prices. Every kWh stored and self-consumed saves more than anywhere else. Batteries pencil out financially even at premium prices that would make no sense elsewhere.

Anyone starting their research should check what state and utility incentives exist in their specific location before comparing product options. A $15,000 battery costing $5,000 net in Connecticut beats a $12,000 battery costing $8,400 net in Texas, even though the Texas price looks lower at first glance.

The Federal Tax Credit

The 30% Investment Tax Credit applies to total installation cost including equipment, labor, permits, and sales tax. A $15,000 installed system generates $4,500 in federal tax credit.

Some important mechanics that salespeople gloss over:

The credit reduces tax liability rather than generating a refund. A household owing $3,000 in federal taxes cannot capture a $4,500 credit in a single year. The unused portion carries forward but may take years to fully use for households with modest tax obligations.

Standalone batteries now qualify without solar panels. This changed in 2022 and opened the market to households with existing solar installations or those simply wanting backup power without generating their own electricity.

The 30% rate holds through 2032, then steps down to 26% in 2033 and 22% in 2034. After 2034, the residential credit disappears under current law. This creates legitimate urgency for those who want batteries eventually, though not urgency that justifies purchasing from whoever creates the most pressure.

Commercial installations can stack additional bonuses for domestic content, energy community locations, and low-income community service. Some commercial projects access 50-70% total credits. Residential buyers cannot access these adders.

State Programs Worth Investigating

California's SGIP remains the nation's most generous program. General participants receive around $150 per kWh. Low-income households in high fire-risk areas can receive up to $1,000 per kWh, enough to cover 60-80% of total system cost. The program operates in funding cycles that open and exhaust unpredictably. Checking current availability before making purchase decisions prevents disappointment.

Connecticut's program structure deserves particular attention. Rather than a simple rebate, Connecticut provides upfront payments plus ongoing compensation for grid services over a ten-year period. The cumulative value can exceed the battery's original cost. The tradeoff: participation requires allowing the utility to dispatch the battery during grid emergencies and submitting to ongoing program requirements.

Massachusetts layers multiple programs. SMART provides ongoing payments for solar-plus-storage systems. ConnectedSolutions compensates demand response participation at rates reaching $275 per kW annually. A household that successfully enrolls in both programs can receive $2,000+ per year in payments beyond whatever energy bill savings the battery provides directly.

New York combines NYSERDA rebates with state tax credits. Neither program is unusually generous, but they stack with the federal credit to produce meaningful net cost reductions for those willing to complete both application processes.

Vermont's utility programs vary by provider but Green Mountain Power offers particularly aggressive incentives including leasing arrangements where the utility provides batteries at reduced cost in exchange for grid services access.

Most other states offer limited or no state-level battery incentives. Buyers outside the states mentioned above should assume the federal credit represents their only substantial subsidy.

Hidden Costs That Surface After Commitment

Published prices almost always exclude expenses that emerge during installation. Budgeting an extra $1,000 to $3,000 for contingencies prevents unpleasant surprises.

Electrical panel upgrades affect perhaps one in four installations. Homes built before 1990 often have 100 or 150 amp service that cannot accommodate battery interconnection without upgrade. Panels from recalled manufacturers like Federal Pacific or Zinsco require replacement regardless of capacity. A panel upgrade runs $1,500 to $4,500 and can delay projects by weeks while waiting for utility coordination.

Conduit runs add cost when batteries install far from electrical panels. Standard quotes assume 25-50 feet of conduit. Longer runs or runs requiring trenching for underground wiring can add $1,000 to $4,000 that initial quotes did not contemplate.

Site preparation varies from zero to several thousand dollars. Outdoor installations need concrete pads. Indoor installations in finished spaces may require drywall removal and restoration. Detached garages or outbuildings require routing power across property, sometimes with trenching.

Utility interconnection delays cost time rather than money directly, but can affect financing terms, incentive availability windows, and the period during which the battery sits idle after installation.

Ongoing costs accumulate quietly. Some manufacturers charge for premium monitoring features. Software updates may eventually require subscriptions. Warranty claims often involve diagnostic visit fees. None of these costs are large individually, but they compound over a fifteen-year ownership period.

Commercial Batteries: Different Economics Entirely

Everything above addresses residential installations where individual buyers purchase single systems. Commercial and industrial projects operate under fundamentally different economics that dramatically reduce per-kWh costs.

A 500 kWh commercial installation might cost $250,000 to $400,000, working out to $500-800 per kWh installed. A 2 MWh installation drops to $400,000 to $700,000, or $200-350 per kWh. Utility-scale projects exceeding 10 MWh have reached below $200 per kWh.

Commercial and utility-scale battery installations benefit from significant economies of scale

The economics differ because scale affects every cost element. Bulk purchasing reduces equipment cost. Standardized containerized designs eliminate engineering expense. Installation labor spreads across more capacity with minimal additional effort. One permit covers an entire large installation rather than requiring individual applications for each small system.

Commercial projects also access more aggressive incentive structures. The federal ITC can stack with domestic content bonuses, energy community bonuses, and low-income community bonuses to reach 50-70% total credits. Some commercial installations effectively cost less than half their pre-incentive price.

For businesses considering battery storage: the economics have become compelling in many situations. Demand charge reduction, time-of-use arbitrage, and demand response compensation can generate returns exceeding typical capital investments. The question has shifted from whether commercial batteries make financial sense to which specific situations justify the capital allocation.

Timing the Purchase

Battery prices have fallen dramatically over the past decade, from above $1,000 per kWh to around $115 per kWh at the pack level. The decline continues at roughly 8-12% annually. Waiting one year saves perhaps $1,000 to $1,500 on a typical residential system.

The case for buying now:

The federal tax credit remains at 30% through 2032 but steps down thereafter. State incentive programs face budget constraints and periodic exhaustion. Electricity rates continue rising in most jurisdictions, increasing the value of each kWh stored and self-consumed. Every year of delay sacrifices a year of utility savings and backup protection.

The case for waiting:

Prices will continue falling. Technology will continue improving. Current batteries are good, but batteries in 2027 will be better and cheaper. Buyers without urgent backup power needs or strong current incentives may benefit from patience.

There is no universally correct answer. Households in states with strong incentive programs that show signs of budget pressure should probably act promptly before funding exhausts. Households in states with weak incentives and no particular urgency around backup power can reasonably wait.

What It Actually Costs

A solar battery bank costs $9,000 to $23,000 installed for residential buyers, with most landing in the $12,000 to $16,000 range for systems providing meaningful backup capability. The 30% federal tax credit reduces this to $8,400 to $11,200 for most buyers. State incentives in California, Connecticut, Massachusetts, and a few other jurisdictions can push net costs down to $3,000 to $8,000 for qualifying households.

The variation reflects installation complexity, regional labor markets, incentive availability, and how effectively buyers negotiate against installer margins. Product selection matters less than most marketing suggests. The underlying technology has commoditized. The cells come from the same factories. The differences lie in software, power ratings, and manufacturer stability rather than fundamental performance.

Ready to proceed? Get multiple quotes, verify incentive eligibility, and budget for contingencies that initial estimates exclude. Still researching? Prices will be lower next year, but current incentives may not remain available indefinitely.

The battery market has matured to the point where storage makes financial sense for many households and businesses under current pricing. Understanding the cost structure reveals where value exists and where margin gets extracted. That understanding translates directly into better purchase decisions and lower actual expenditure.