The quoted range of $3,000 to $25,000 spans nearly an order of magnitude—so wide that it tells buyers almost nothing useful. This vagueness exists by design. Battery manufacturers and distributors benefit enormously from buyer confusion, while purchasing managers navigate a market where the relationship between price and value stays deliberately hidden.

A $17,000 battery sitting on a warehouse floor likely cost $4,000 to manufacture and ship. The spread between production cost and selling price exceeds what most industrial equipment categories tolerate, yet the forklift battery market sustains these margins through information asymmetry and fragmented buyer knowledge.

Standard purchasing guides compound the problem by focusing exclusively on upfront cost comparisons. Such analyses miss the fundamental reality: purchase price represents perhaps one quarter of actual battery expenditure over a working lifetime. The remaining three quarters accumulate through energy consumption, labor allocation, operational disruption, and replacement frequency. A procurement process optimizing for invoice price while ignoring downstream costs ends up costing more than the supposedly expensive alternative.

Manufacturing Economics Exposed

The cost structure of lithium forklift batteries looks absurd once the actual component economics come into focus.

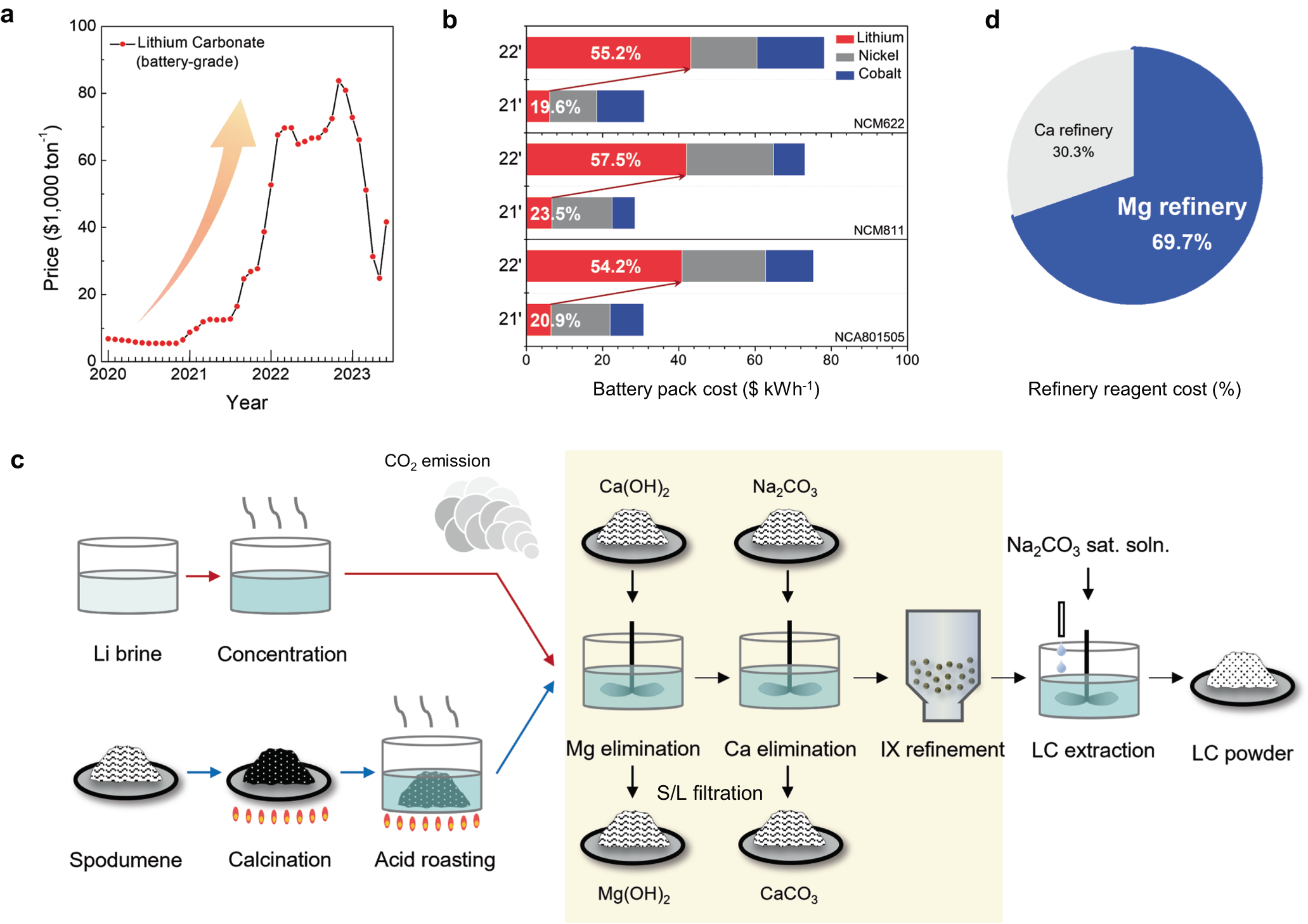

Lithium iron phosphate cells, the core technology in forklift applications, trade at $50 to $70 per kilowatt-hour when purchased in volume from Chinese manufacturing facilities. A typical mid-size forklift battery contains approximately 24 kilowatt-hours of storage capacity. The cell content of such a battery therefore costs between $1,200 and $1,680 at current market rates.

Battery management systems sourced from established Chinese electronics manufacturers add $500 to $1,200 depending on feature set and component quality. Steel enclosures, thermal management hardware, wiring harnesses, and industrial connectors contribute $600 to $900 more. Assembly labor, quality testing, and factory overhead in Shenzhen-area facilities run another couple hundred dollars per unit.

Container shipping across the Pacific adds roughly $300 per battery when consolidated with other freight.

Total manufactured and delivered cost for a battery meeting reasonable quality standards:

That same battery appears on American warehouse loading docks with price tags of $14,000 to $20,000.

Three factors account for this gap. United States tariff policy imposes duties of 70% to over 150% on Chinese-origin lithium batteries, with the exact rate depending on how customs officials decide to classify the shipment. Distribution channel economics capture another 25% to 40% of final selling price. Brand positioning adds whatever the market will bear on top of that.

A purchasing manager evaluating quotes from competing suppliers typically compares products with entirely different cost structures, tariff exposures, and margin expectations. The $11,000 quote from an unfamiliar Chinese brand routing through Southeast Asian assembly may contain superior cells and more sophisticated electronics than a $19,000 offering from an established Western name. Alternatively, the cheaper option may incorporate inferior components across every category. Price comparison alone reveals nothing about what occupies the steel enclosure.

Quality Differentiation Beyond Specification Sheets

Cell grading determines battery performance and longevity more than any printed specification, yet remains invisible in marketing materials and sales presentations.

Every lithium cell production line generates output across a quality spectrum. Cells with tightly matched capacity ratings, uniform internal resistance, and clean defect screening results flow to automotive manufacturers with rigorous incoming inspection protocols. Cells meeting acceptable but less stringent criteria flow to industrial and commercial buyers. Cells at the bottom of the quality distribution find homes wherever price sensitivity overwhelms quality concerns.

Batteries assembled from premium-grade cells deliver consistent performance across an eight to twelve year operational life. Cells age at similar rates, capacity degrades uniformly, and the management system maintains balance without strain. Batteries incorporating lower-grade cells begin exhibiting problems around year three or four. Individual cells weaken at different rates, dragging pack performance downward. The management system struggles to compensate for growing imbalances. Capacity fades faster than specification sheets suggested.

No published specification indicates cell grade. No sales representative volunteers the information. Price positioning and manufacturer reputation provide the only reliable signals.

No published specification indicates cell grade. No sales representative volunteers the information. Price positioning and manufacturer reputation provide the only reliable signals. Batteries priced substantially below market comparables almost certainly contain inferior cells. The initial savings evaporate when premature replacement becomes necessary.

Battery management system quality varies just as widely, and the consequences are just as real. A competently engineered BMS performs continuous cell balancing during both charge and discharge cycles, distributing energy to prevent individual cells from diverging in state of charge. Temperature monitoring occurs through sensors positioned throughout the pack rather than at a single measurement point. The system logs operational data—cycle counts, temperature excursions, error conditions—creating diagnostic records invaluable for troubleshooting. Communication protocols enable integration with forklift control systems, fleet management platforms, and service diagnostic tools.

Budget-tier management systems perform balancing only during charging cycles, using resistive bleeding that wastes energy as heat. Temperature sensing occurs at one location, missing thermal variations across the pack. No logging capability exists. Communication with external systems ranges from minimal to nonexistent.

Both battery configurations function identically during initial deployment. The performance gap opens over years of operation, showing up as capacity divergence, unexplained behavior, and diagnostic blind spots when problems develop.

Thermal management capability determines viability for cold storage applications. Lithium battery chemistry prohibits charging at temperatures below freezing. The electrochemical process under cold conditions causes lithium metal plating on cell anodes, inflicting permanent structural damage. Batteries deployed in freezer warehouse environments require integrated heating systems that warm cells to safe temperatures before charging sequences begin. The heating hardware adds $350 to $500 to manufacturing cost.

Procurement decisions that omit heating capability for cold storage applications destroy batteries worth twenty times the savings. This failure mode occurs repeatedly when purchasing processes treat all warehouse environments as interchangeable.

Where the Real Money Goes

The expenditures following battery purchase dwarf the purchase price itself for most operations.

Energy efficiency alone justifies serious attention. Lead-acid batteries achieve round-trip efficiency of approximately 75%, meaning one quarter of input electricity converts to heat rather than stored energy. Lithium batteries achieve 92% to 95% efficiency consistently across their operating envelope. A forklift consuming 25 kilowatt-hours of motive energy per shift, operating two shifts daily across 250 working days annually, requires 16,667 kilowatt-hours of grid electricity with lead-acid batteries versus 13,700 kilowatt-hours with lithium.

At commercial electricity rates of $0.14 per kilowatt-hour, this efficiency gap translates to $415 annual savings per forklift. A thirty-unit fleet saves $12,450 annually on electricity alone. Across a ten-year lithium battery service life, cumulative energy savings exceed $120,000 for a fleet of that size.

Annual Cost Comparison: 30-Unit Fleet

Maintenance labor adds an even larger gap. Lead-acid battery operation requires weekly attention: water level inspection and replenishment, terminal cleaning, specific gravity measurement, and periodic equalization charging. Each battery demands 20 to 30 minutes of labor weekly to maintain proper operating condition. A fleet operating sixty lead-acid batteries for multi-shift coverage consumes 25 to 35 hours of maintenance labor every week, or 1,300 to 1,800 hours annually.

At fully loaded labor cost of $32 per hour including wages, benefits, and supervision, lead-acid battery maintenance absorbs $42,000 to $58,000 annually for a fleet of that size. Lithium batteries require no routine maintenance. The battery management system handles cell balancing automatically. No electrolyte exists to replenish. No equalization cycles provide benefit. The maintenance labor allocation drops to zero.

Battery swap logistics pile on additional cost for multi-shift operations. Lead-acid batteries provide roughly six hours of operation before requiring recharge, and the recharge-plus-cooling cycle spans sixteen hours. Continuous multi-shift operations therefore maintain two or three batteries per forklift position, swapping depleted units for charged replacements during operation.

Each swap sequence consumes fifteen to twenty minutes: operator travel to the battery staging area, equipment positioning, depleted battery extraction, charged battery installation, connection verification, and return travel to productive work. Two-shift operations require at least one swap daily. Annual swap time per forklift reaches 130 to 170 hours of combined equipment and operator time lost to battery logistics.

Lithium batteries accept opportunity charging at any state of charge without cycle life penalty. Operators connect chargers during scheduled breaks, meal periods, and shift transitions. A single battery per forklift position sustains continuous multi-shift operation. The swap labor, the staging area, and the spare battery inventory all become unnecessary.

Across a full decade of operation, the battery purchased at a lower invoice price frequently costs twice as much as the more expensive alternative when operating expenditures accumulate. Capital budget processes that blocked lithium conversion to protect upfront cost often imposed operating cost penalties far exceeding the avoided purchase premium.

Brand Premium Examination

Western battery brands command 50% to 100% higher prices than Chinese manufacturers for products that frequently share identical cell sourcing and comparable component specifications. What does that premium actually buy?

Warranty coverage runs five years from Western brands, compared to two or three years from most Chinese manufacturers. Whether this extension matters depends on when batteries actually fail. Lithium battery warranties cover manufacturing defects, not operational wear. Capacity degradation must fall below 70% or 80% of original rating to trigger warranty eligibility, and establishing that threshold requires diagnostic testing that most operations never bother with.

The exclusion list tells the real story. Damage from charging protocol violations, operation outside temperature specifications, physical abuse, water intrusion, and "abnormal use"—a term defined loosely enough to justify denying almost any claim. Batteries that survive the first ninety days without manufacturing defect manifestation tend to run through their full design life without warranty-eligible failures. Problems cluster at the beginning and at the end. The warranty extension covers the quiet middle years when little goes wrong anyway.

Technical support infrastructure exists within North America for Western brands. Chinese manufacturers generally lack equivalent local presence, which matters for operations without in-house electrical expertise. For operations with capable maintenance staff, the value diminishes. Lithium batteries do not demand the constant attention lead-acid requires. When problems occur, they usually involve BMS communication issues or data interpretation questions—things addressable through remote diagnostic review. On-site service intervention happens infrequently in well-run lithium installations.

Brand reputation meant something a decade ago. Chinese battery manufacturing at that time produced erratic quality, and Western brands delivered genuine reliability advantages worth paying for. That gap has largely closed. Chinese manufacturers now operate at production scales that Western competitors cannot approach. CATL alone produces more lithium cells annually than all North American and European manufacturers combined. Production volume funds automation, process control, statistical quality systems, and testing infrastructure that smaller operations cannot justify economically.

Quality variation persists within both Chinese and Western manufacturer populations. The worst Chinese suppliers produce genuinely inferior products. The worst Western suppliers charge premium prices for mediocre products. Quality discrimination requires evaluating specific manufacturers based on documented track records rather than applying geographic assumptions.

The brand premium remains appropriate for buyers unwilling or unable to perform detailed supplier evaluation, accepting higher cost in exchange for reduced procurement risk. Buyers willing to invest evaluation effort capture substantial savings from qualified Chinese manufacturers, often enough to fund a complete spare battery while retaining surplus.

The Tariff Situation

United States tariff policy on Chinese lithium batteries makes no industrial sense. Import duties run from 70% to over 150% depending on how customs classifies the shipment, effectively doubling or tripling the landed cost of Chinese-origin products. These duties do not protect American manufacturing. The United States has almost no lithium iron phosphate production capacity worth protecting. The tariffs simply raise costs for American buyers while European and Asian competitors face no equivalent penalty.

The market response was predictable. Chinese manufacturers ship components to Vietnam, Thailand, Malaysia, and Mexico for final assembly, producing goods that qualify for lower duties under applicable trade agreements. The batteries still contain Chinese cells, Chinese battery management systems, Chinese structural components, Chinese engineering. Only the assembly location changes.

American warehouse operators end up paying elevated prices for products that remain Chinese in every meaningful respect, just carrying different paperwork. The tariff structure functions as a tax on American logistics competitiveness rather than protection for American industry.

Enforcement scrutiny on these arrangements keeps increasing. Customs authorities challenge origin determinations and assembly documentation more aggressively each year. The structure could shift further with policy changes or administration transitions. Any procurement strategy that assumes current tariff conditions will hold indefinitely is making a risky bet.

When the Numbers Work

The financial case for lithium depends almost entirely on how hard the forklifts work.

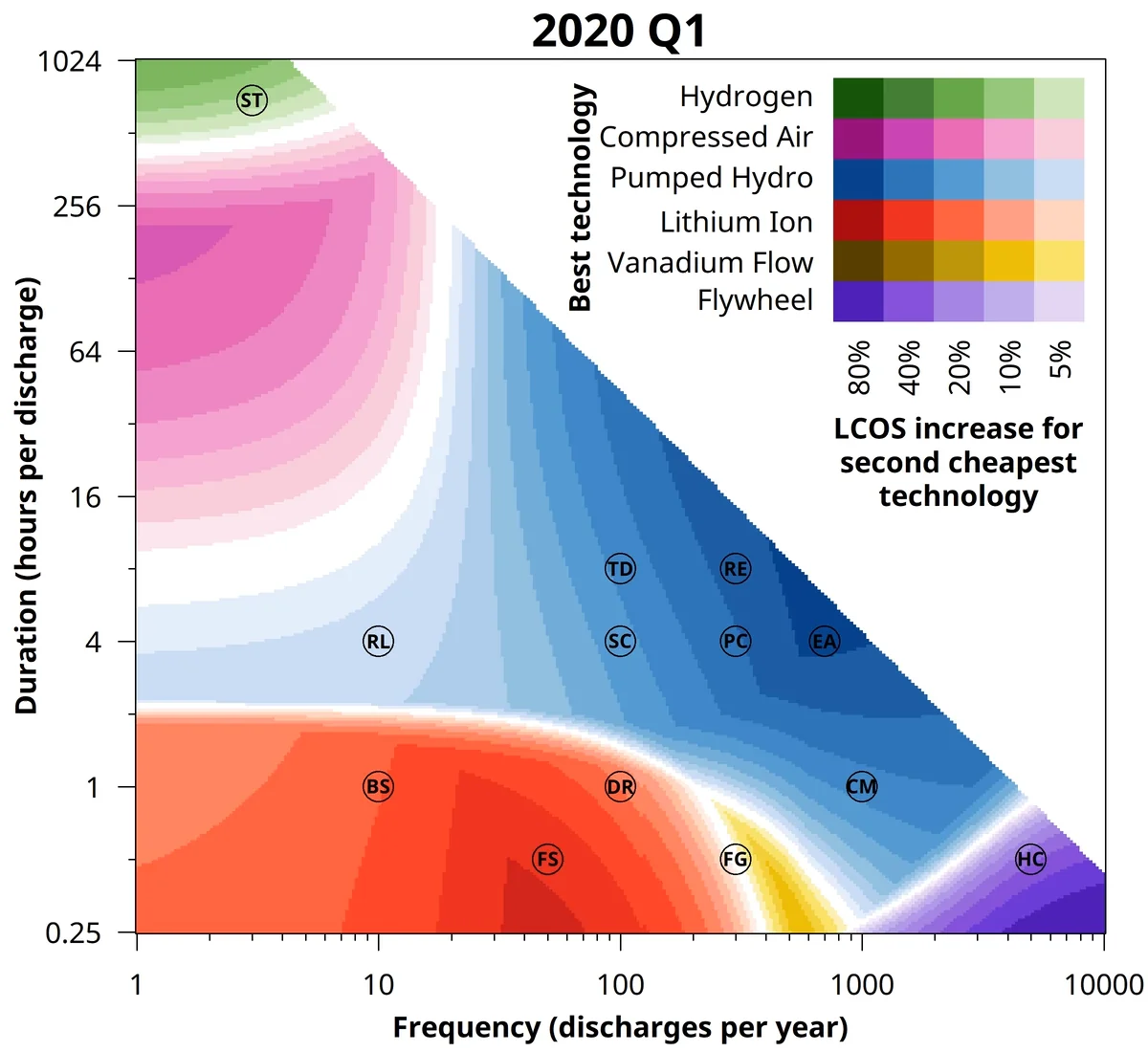

Two-shift and three-shift operations hit payback within eighteen months to two and a half years under typical conditions. Energy savings, maintenance elimination, and recovered swap time generate returns that blow past the purchase premium fast. For these operations, sticking with lead-acid while waiting for lithium prices to drop further destroys value. The operational penalties piling up during the wait exceed any realistic future savings on purchase price.

Single-shift operations present a weaker case. Lower utilization shrinks the energy savings and makes swap elimination less valuable. Returns take four to six years to materialize. The math still favors lithium over a full battery lifetime, but extended payback complicates capital budget approvals.

Cold storage operations gain the most from switching. Lead-acid batteries lose a third or more of their effective capacity at freezing temperatures, forcing frequent swapping in cold environments. Lithium batteries with proper heating systems hold full rated capacity regardless of ambient temperature. The advantage in freezer warehouses runs well beyond the advantage in climate-controlled facilities.

Before Signing Anything

Cell sourcing deserves more attention than purchasing departments typically give it. Press manufacturers to name their cell suppliers and specify quality grades. Evasive responses or vague claims about "premium cells" and "tier-one suppliers" without naming names suggest sourcing the manufacturer would rather not discuss. The major cell producers—CATL, BYD, EVE Energy, CALB—have well-documented reputations. Batteries built from identified top-tier production justify confidence. Batteries with murky origins warrant skepticism.

BMS capabilities vary more than most buyers realize. Does the system perform active balancing during discharge, or only passive balancing during charging? How many temperature sensors monitor the pack, and where are they positioned? What data gets logged, and how can it be accessed later for diagnostics? What communication protocols enable integration with forklift systems and fleet management platforms? Specific technical answers indicate serious engineering. Buzzword-heavy responses about "advanced protection" and "intelligent management" indicate a marketing department that got to the spec sheet before the engineers did.

Charger compatibility trips up buyers who do not check. Some batteries require proprietary charging equipment. Others work with standard high-frequency industrial chargers when configured properly. A proprietary charger requirement can add $30,000 to $50,000 across a thirty-unit fleet and lock an operation into ongoing vendor dependency. That number belongs in the procurement evaluation, not in a post-purchase surprise.

Warranty documentation needs examination beyond the headline duration number. What capacity threshold triggers claims? What exclusions apply? What documentation must accompany a claim? How long does resolution typically take? A warranty that sounds generous but involves an arduous claims process provides minimal actual protection.

Reference customers in comparable applications provide a reality check that sales materials cannot. Ask for contacts at operations with similar equipment, similar utilization, and similar environmental conditions. Make those calls. Performance realities, support responsiveness, and problem resolution effectiveness become clear in ways that brochures never reveal. Vendors who decline to provide references are telling buyers something important.

Asking what a forklift lithium battery costs puts attention on the wrong number. What matters is what continued lead-acid operation costs.

The Question Worth Asking

Asking what a forklift lithium battery costs puts attention on the wrong number.

What matters is what continued lead-acid operation costs—in wasted electricity, in maintenance labor, in swap logistics, in spare battery inventory sitting idle, in replacement cycles that come around every few years instead of every decade. For multi-shift warehouse operations, that ongoing drain exceeds lithium conversion cost by embarrassing margins.

The battery that looks expensive on a purchase order often delivers the lowest total expenditure across its working life. The battery that looks like a bargain often becomes the most expensive asset in the building once the true costs stack up over years of operation.

Procurement processes that cannot see past sticker prices pay more while getting less. Battery cost is not a line item on an invoice. It is the accumulated consequence of decisions playing out across a decade of warehouse operations—decisions that the initial purchase either enables or forecloses.