What Are the Best 48V Lithium Battery Manufacturers?

The Short Answer

Pylontech for residential solar. Best inverter compatibility, warranty actually gets honored.

BYD builds the best batteries period. Finding stock outside California is a nightmare.

Trojan for golf carts. The dealer network is worth the premium.

Victron only makes sense if you're buying everything from them. Otherwise you're paying for a logo.

I've lost count of how many Intersolar Europe booths showed the exact same 48V 100Ah rack-mount unit with different stickers. Same enclosure, same LCD, same terminals. The only thing that changed was the logo.

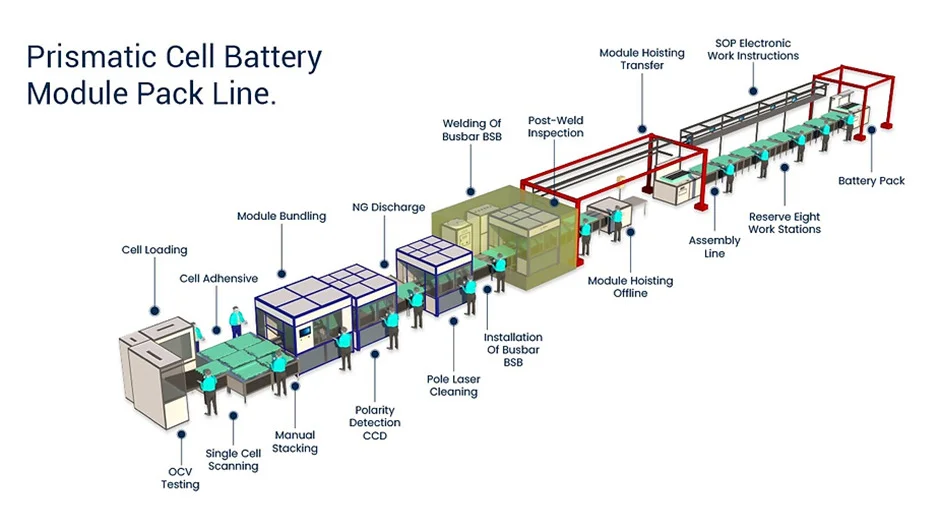

Making batteries takes real work. Cell sourcing, BMS development, thermal design. Selling batteries takes a website and enough cash for a container. The second barrier is laughably low, which explains the flood of trading companies pretending to be manufacturers.

Canton Fair is worse. I watched a factory rep hand out business cards for three different "companies" in one afternoon. He kept forgetting which brand he was supposed to represent. That tells you everything about this market.

The consequences of picking wrong range from annoying to potentially fatal. Best case: warranty claims that vanish into a void, firmware updates that never arrive, support emails that bounce. Worst case: thermal runaway from cells that should have been recycled, fires from defects that real QC would have caught. The Arizona garage fire made local news. Similar incidents happen constantly but rarely get reported.

Early 2024, a no-name 48V battery from Amazon experienced thermal runaway during charging and destroyed a garage in Arizona. The brand disappeared from Amazon within weeks. The homeowner had zero recourse. Fire investigators now specifically ask about battery installations during their interviews.

Cell Grades Matter More Than You Think

CATL and BYD grade every cell before shipping. Grade A meets spec. Grade B is close enough. Grade C should go to recycling but ends up in Huaqiangbei, where traders dig through reject bins and resell to whoever will buy.

When lithium carbonate crashed in 2023, Grade A cells got cheap and the arbitrage opportunity closed. Tight markets bring the gap back. A pack built from Grade C cells costs maybe $300 less than one built properly. The spec sheet looks identical because budget brands just copy numbers from Grade A datasheets. I've seen this happen firsthand at multiple factories.

Pylontech claims vertical integration at their Jiangsu facility. Hard to verify since Chinese manufacturers guard supply chains like state secrets. What I can verify is that Pylontech has made consistent claims for over a decade without getting caught lying. That counts for something. BYD makes everything in-house, no ambiguity.

EVE Energy supplies cells to a huge chunk of the 48V market. Company has been around since 2001, hit 100GWh cumulative production in 2023. Their LFP cells show up in LiTime, Ampere Time, and various other brands. Not CATL or BYD quality, but consistent enough for people who accept the tradeoffs.

CALB serves the mid-tier. Better than EVE, not quite CATL. Plenty of installers use CALB cells without knowing it because pack manufacturers don't disclose sourcing. CALB runs 10-15% cheaper than CATL at wholesale.

The real danger is no-name cells from secondary factories. Places buying scrap materials, running without QC, shipping whatever comes off the line. Cells might work. Cells might have defects that show up years later. No traceability, no accountability.

Certifications: What Actually Matters

UL 1973 is the only certification I trust for North America. Underwriters Labs takes production samples and tries to destroy them. Overcharge, overdischarge, external shorts, crush tests, thermal abuse. Batteries have to survive without fire. Testing costs $50,000-150,000. Budget brands skip it and pray nobody checks.

IEC 62619 covers similar ground for European and Asian markets. Commercial EU installations technically require it. Residential systems slip through cracks.

UN 38.3 gets abused constantly. It covers lithium cell transportation. Every legitimate lithium cell passes because you can't legally ship lithium without it. Manufacturers citing UN 38.3 as proof of quality are bragging about meeting the minimum requirement for putting cells on an airplane. That's like a restaurant bragging they passed health inspection.

CE marking means nothing. Manufacturers self-declare conformity. No third-party testing required. Stick a CE mark on anything you want and start selling.

FCC certification is for radio frequency interference, not battery safety. A battery with FCC certification has been tested to make sure it doesn't mess with your wifi. That's it. Anyone emphasizing FCC for batteries is trying to distract you.

| Certification | What It Means | Verification |

|---|---|---|

| UL 1973 | Abuse testing passed | ul.com/database |

| IEC 62619 | International equivalent | certificates.iecee.org |

| UN 38.3 | Transport safety only | Minimum for shipping |

| CE | Self-declared | Worthless |

BMS Is Where Cheap Batteries Fail

I've seen dozens of premature failures. Almost all traced to BMS problems, not cells. Balancing current too low. Temperature compensation treating the whole pack as one zone. Communication protocols half-implemented so the inverter falls back to generic charging curves that slowly murder the cells.

Active balancing transfers charge between cells. Passive balancing burns excess off as heat. Budget boards run 30-50mA passive balancing. Takes forever to correct drift, never catches up on heavily cycled packs. Pylontech and BYD run active balancing. Makes a real difference after year three.

Cell monitoring granularity varies wildly. Premium BMS tracks every cell individually. Sixteen separate voltage readings for a 16S pack. Budget BMS monitors cell groups, maybe four readings for the same pack. When one cell drifts, the BMS can't identify it. The whole group gets penalized, wasting capacity from healthy cells.

Temperature compensation on good BMS adjusts parameters based on actual temperature. Cold cells need lower charge rates. Hot cells need lower voltages. Budget BMS uses binary cutoffs. Pack hits 45°C and charging stops dead instead of gradually reducing. Pack drops to 5°C and charging continues at full rate. Both approaches damage cells.

DVCC (Distributed Voltage and Current Control) is where you see the difference. Full implementation lets the inverter request specific charge parameters. Battery responds with what it can actually accept. Half-implemented DVCC sends some parameters but not others. Inverter guesses at missing values. Sometimes guesses wrong.

JBD and Daly boards work fine for basics. Overcharge protection, short circuit protection. Optimization is where they fail.

Overkill Solar and REC BMS serve DIY builders. Better monitoring, better balancing, Bluetooth configuration. Cost more than generic boards but less than premium pre-built packs. Makes sense if you have the skills.

Installation Separates Amateurs from Professionals

A 5kW inverter pulls over 100A from a 48V bank at full load. Run that through undersized wire and voltage drop eats performance. 100A through 10 feet of 4 AWG copper drops about 0.4V. Nearly 1% of nominal voltage just heating up wire. I use 2/0 or bigger for main battery runs.

Crimp quality determines whether connections last. Proper crimps use hydraulic tools that compress lugs evenly. Hammer crimps create uneven compression that loosens over time. Loose connections increase resistance, generate heat, cause failures. A $200 hydraulic crimper pays for itself after one avoided problem.

Torque specs matter. Under-torqued connections loosen from thermal cycling as the battery heats and cools. Over-torqued connections strip threads or crack housings. Manufacturer documentation specifies values. Most residential installers eyeball it.

| System Size | Max Current | Minimum Wire | Recommended |

|---|---|---|---|

| 3kW | 65A | 6 AWG | 4 AWG |

| 5kW | 105A | 4 AWG | 2 AWG |

| 8kW | 170A | 2 AWG | 1/0 AWG |

| 10kW | 210A | 1/0 AWG | 2/0 AWG |

NEC Article 706 covers energy storage. Disconnect switches, overcurrent protection, labeling. California adds Title 24 rapid shutdown requirements. Some jurisdictions permit anything under 20kWh without inspection. Others want permits for anything over 1kWh. Check before ordering or you might discover your planned installation can't be permitted.

Most 48V systems run floating, neither terminal grounded. Works until someone connects an inverter expecting grounded neutral. Nuisance faults, system trips offline, installer wastes hours chasing a configuration mismatch that should have been caught before equipment arrived.

CAN bus communication needs termination. 120Ω resistors at each end, should measure 60Ω total across the bus. Missing termination causes random dropouts. Running comm cables next to AC power induces noise. Shielded cable and separate routing fix intermittent faults that otherwise take forever to diagnose.

RS485 has polarity headaches. A/B labeling isn't standardized. Some manufacturers label Data+ as A, others as B. Swapped polarity fails silently. Trial and error or reading documentation. The frustrating part: nothing breaks, it just doesn't work.

Pylontech

Pylontech runs 15 cells for 48V nominal instead of 16 cells for 51.2V. Forum critics call it cost-cutting. They're missing the point. 48V matches legacy telecom and golf cart setups exactly. No charge controller reconfiguration needed. That backward compatibility drove market share and I think it was the right call.

The real value is the inverter compatibility list. Victron, SMA, Solax, Goodwe, Fronius, Sungrow. Pylontech tests against all of them, sometimes before product launches. When Victron pushed a DVCC update that broke some third-party batteries, Pylontech units kept working. That kind of pre-release coordination takes years of relationship building. I've seen competitors scramble to fix compatibility while Pylontech users didn't even notice there was an update.

US-series evolution tracked installer feedback. Original US2000 had capacity complaints. Too many modules needed for reasonable storage. US3000 addressed it. US5000 expanded temperature range after Arizona installers reported summer shutdowns. They actually listen.

US5000 units run $900ish wholesale, maybe $1,200-1,400 retail. Ten-year warranty backed by a company that has money and will exist in ten years. Not exciting. Just works. That's exactly what I want from a battery.

BYD

Blade Battery throws out conventional pack design entirely. Elongated prismatic cells double as structure, heat conducts along the length toward edges. The nail penetration videos are real. Independent labs replicated them. Competing packs catch fire. Blade cells sit there warm. I've watched demos that made me reconsider everything I thought I knew about LFP safety margins.

The architecture came from automotive. BYD needed to solve thermal runaway for EVs where pack fires mean headlines and recalls. Elongated geometry distributes mechanical stress across larger area. Iron phosphate chemistry provides additional thermal stability. Combined effect: cells that survive abuse testing other designs fail.

B-Box Premium brings automotive tolerances to residential storage. Tighter than anything else at this price. The problem is finding stock. BYD's EV business ate executive attention. North American energy storage distribution never got built out. California has dealers. Most of the country does not. I've had clients wait months for units.

Pricing runs competitive with Pylontech when you can find units through authorized channels. Gray market imports exist but warranty support becomes questionable. B-Box HVM modules run roughly $850 per 2.76kWh when available.

BYD published 8,000+ cycles at 90% depth of discharge. Numbers that good sound like marketing fiction until you remember their EV warranty obligations. BYD guarantees automotive packs for 8 years. They would face billions in warranty costs if cells degraded faster than claimed. The residential products use the same technology. I believe the numbers.

If you can source BYD through proper channels, buy it. The engineering is simply better than everything else at this price point. The distribution problem keeps getting mentioned because it's the only thing stopping me from recommending BYD to everyone.

Victron Energy

Spec-for-spec, Victron batteries cost 30-50% more than Pylontech. Same cells, similar capacity. The premium buys ecosystem integration. VE.Bus, VE.Direct, VRM monitoring, one vendor for everything. When a multi-brand system throws communication faults, three vendors point fingers. Victron avoids that by owning the whole stack.

Remote off-grid installations where one avoided truck roll covers the markup? Worth every penny. Grid-tied suburban install where a technician can drive over in an hour? Hard to justify. I only recommend Victron to clients who are going all-in on their ecosystem or who are in genuinely remote locations.

Trojan Battery

Trojan dominated lead-acid golf cart batteries for decades. Lithium transition came late. Protecting existing revenue made short-term sense. Allied and Dakota grabbed market share while Trojan watched. By the time OnePack launched, competitors had established positions.

OnePack 48V runs $3,200-3,600 at dealers. Thousand dollars more than Allied or Dakota. The premium buys dealer network access. Thousands of golf cart shops stock Trojan, know the product, handle warranty locally. BMS handles motor transient spikes that trip solar-focused batteries. Drop-in fitment for Club Car, EZGO, Yamaha without adapter plates.

The warranty structure reflects confidence: 8 years total, 4 years full coverage plus 4 years prorated. Company has over $500 million annual revenue. Claims get processed. Company will exist when warranty needs exercise.

Fleet buyers benefit most. Golf course with 80 carts can negotiate volume, standardize on one battery type, train maintenance staff once. Individual owner replacing one cart battery feels the premium more acutely.

DIY types find equivalent specs cheaper. Everyone else is paying for the service network, and for golf carts specifically, that network is worth paying for.

Parallel Systems Are Where Things Get Complicated

Pylontech allows 16 US5000 units in parallel for 76.8kWh total. BYD caps B-Box HVM at 8 modules for 22kWh. Victron goes to 20 units with proper CAN configuration. These limits exist because parallel operation gets complicated fast.

Current sharing depends on impedance matching. Lower internal resistance means higher current draw. The battery that works hardest degrades fastest, which lowers its resistance further, which makes it work even harder. Positive feedback loop until something fails.

Manufacturing tolerances determine initial impedance matching. Premium batteries from the same batch match closely enough that current sharing stays reasonably balanced. Budget batteries from inconsistent manufacturing show wider variance. Two batteries from the same model might have 10-15% internal resistance difference, causing uneven current sharing from day one.

Connecting batteries at different states of charge causes trouble. High SOC battery dumps current into low SOC battery as they equalize. Current that bypasses BMS limiting because it flows battery-to-battery instead of through the load path. Several documented fires started exactly this way. Match SOC before paralleling. I cannot stress this enough.

The equalization current can be enormous. A fully charged 100Ah battery connected to a fully discharged 100Ah battery might see 200-300A flowing between them. That current generates heat, stresses cells, potentially damages weak units. Premium BMS limits inter-battery current. Budget BMS may not.

Adding new batteries to old banks creates similar problems. Fresh battery at full capacity, old batteries already degraded. New unit absorbs disproportionate current, ages faster. Installing full planned capacity upfront usually costs less than incremental expansion when you factor in accelerated degradation.

| Battery | Max Parallel | Max Capacity | Communication |

|---|---|---|---|

| Pylontech US5000 | 16 | 76.8 kWh | CAN daisy-chain |

| BYD B-Box HVM | 8 | 22 kWh | Proprietary |

| Victron Smart | 20 | Variable | CAN configurable |

| LiTime | 4 | ~20 kWh | None |

Budget batteries often lack inter-battery communication entirely. Multiple LiTime units in parallel operate as independent packs without coordination. Each battery manages its own cells without knowing what the others are doing. Works for small parallel configurations. Breaks down in larger configurations where battery-to-battery coordination becomes necessary.

Budget Tier: What You're Actually Getting

LiTime has been around a few years without major disaster. Sells through Amazon, answers emails, ships product. 48V 100Ah runs $700-900 depending on promotions. Forum reports suggest acceptable failure rates but real long-term data doesn't exist yet.

The company maintains US-based customer service and processes warranty claims domestically. Response times run faster than direct-from-China competitors. Technical support can actually troubleshoot rather than reading scripts. For budget buyers, that infrastructure justifies paying slightly more than bottom-dollar alternatives.

Battle Born charges premium-budget prices ($2,000+) for marketing rather than engineering. Heavy YouTube sponsorship presence. Product works fine. Pricing reflects ad spend. The company has better name recognition among RV owners than any actual battery manufacturer, which tells you where the money goes.

Battle Born's Reno headquarters provides domestic warranty service. Company has been around since 2016. Products get assembled in the US from imported cells. "Made in USA" claims technically accurate for assembly, though cells come from China like everyone else's.

Below that: Ampere Time, Lossigy, Weize. Teardown videos show inconsistent build quality between units of the same SKU. Some buyers get years of service. Others get warranty claims. Manufacturing tolerances appear loose enough that quality varies unit-to-unit. You're rolling dice.

Ampere Time pricing dips into $500-600 during Amazon sales. At that price point, you're gambling on individual unit quality rather than relying on consistent manufacturing.

Weize targets absolute budget. Prices sometimes drop below $400 for 48V 100Ah during promotions. At that price point, cell quality and BMS functionality become serious questions. Teardown videos show components that wouldn't pass incoming inspection at reputable manufacturers.

Amazon brands that appear and disappear every few months are liquidating reject inventory. Same enclosure, new logo. No real warranty because no real company. Prices look good because nobody pays for engineering or support. I've seen the same factory photos used by four different "brands" in a single month.

Replacing Lead-Acid: Don't Just Swap

Direct lead-acid replacement without configuration changes causes problems. Charging profiles differ enough that plugging lithium into a lead-acid charger trips BMS protection immediately.

Lead-acid 48V charges to 57-59V for flooded cells, sometimes 60V+ during equalization. LFP wants 54-57V max with no equalization. Battery looks broken when the BMS refuses overvoltage. Won't accept charge, throws codes. Owners expecting drop-in compatibility get confused and think they received a defective unit.

The confusion comes from marketing. "Drop-in replacement" appears everywhere. Physical dimensions often do match. Electrically, the systems require completely different charge parameters. Drop-in physically, not drop-in electrically.

Absorption timing matters. Lead-acid needs 2-4 hours at elevated voltage to finish charging. LFP reaches full charge fast once hitting target voltage. Extended absorption just stresses cells. Lithium-compatible chargers terminate on current taper instead of fixed time.

Multi-stage chargers designed for lead-acid implement equalization cycles pushing voltage to 60V+ periodically. LFP cells don't stratify and don't need equalization. Running equalization on lithium triggers BMS protection or, worse, damages cells if protection fails to activate fast enough.

| Parameter | Flooded Lead-Acid | AGM | LFP |

|---|---|---|---|

| Charge Voltage | 57-59V | 56-58V | 54-57V |

| Float | 54-55V | 54-55V | 53-54V or off |

| Equalization | 60-62V | No | Never |

| Absorption Time | 2-4 hours | 2-4 hours | Current-based |

Some older inverters designed for lead-acid interpret LFP's flat voltage plateau as a fault. Others lack lithium charge profiles entirely. Check compatibility before buying replacement batteries. Discovering the inverter can't support lithium after the old bank is gone creates expensive problems.

| Brand | Best For | Price (48V ~100Ah) | My Take |

|---|---|---|---|

| Pylontech | Residential solar | $900-1,400 | Default recommendation |

| BYD | Anyone who can source it | $850-1,100 | Best engineering, buy if available |

| Victron | Remote off-grid only | $1,300-1,800 | Full ecosystem or skip |

| Trojan | Golf carts | $3,200-3,600 | Worth it for dealer network |

| LiTime | Budget residential | $700-900 | Acceptable risk for price |

How to Verify Claims Before Buying

UL database (ul.com/database) lets you search certification status of specific battery models. Many budget brands provide certificates that apply to different products, expired certificates, or certificates from testing bodies that don't exist. Cross-reference certificate numbers with issuing organization databases. IEC certificates verify through certificates.iecee.org.

Document fraud happens constantly. I've seen certificates with altered dates, certificates issued to different companies, certificates for products with different model numbers. UL file numbers are searchable. Legitimate manufacturers provide verifiable documentation without prompting. If they make excuses, walk away.

Company registration date matters for warranty reliability. A company registered in 2023 cannot honor a 10-year warranty no matter what the document says. Chinese manufacturers registered with Shenzhen Administration for Market Regulation appear in searchable databases. US LLCs in Nevada or Wyoming need extra scrutiny since those states allow registration with minimal documentation.

Forum history gives real-world data. DIYSolar.com, secondlifestorage.com, Reddit solar communities. Search the company and model name. No discussion about a supposedly popular battery brand? Questions about actual market penetration. Multiple similar failure reports? Systemic problems marketing materials omit.

Forum posts from two or three years ago provide better signal than recent reviews. A battery that worked fine for six months might fail at eighteen months. Finding users who have run specific batteries for multiple years gives real reliability data.

Will Prowse's teardown videos reveal build quality photographs can't capture. Thermal paste application, cell alignment, wire gauge, crimp quality. Battery claiming CATL cells but teardown shows unmarked cells? Skepticism warranted regardless of spec sheet claims.

Inverter manufacturer compatibility lists provide independent verification. Victron publishes specific models tested and confirmed. SMA maintains similar lists. If a battery claiming Victron compatibility doesn't appear on Victron's list, the claim is unverified at best.

Price-to-specification ratio tells you something. A 48V 100Ah battery at $500 cannot include Grade A cells, proper BMS, UL certification, and company profit. The math doesn't work. Either specs are inflated, quality is compromised, or the company is losing money unsustainably.

Application Matching

A battery optimized for residential solar performs poorly in a golf cart. A battery designed for RV house loads fails in marine applications. Match the battery to the use case.

| Application | Requirements | Recommended | Avoid |

|---|---|---|---|

| Residential Solar | Inverter compatibility, cycle life, warranty | Pylontech, BYD | Golf cart batteries, unbranded imports |

| Off-Grid Cabin | Wide temp range, remote monitoring | Victron ecosystem, Pylontech | Budget brands without cold protection |

| Golf Cart | Motor surge handling, dealer network | Trojan, Allied, Dakota | Solar storage batteries |

| RV | Vibration tolerance, weight | Battle Born, LiTime | Rack-mount systems |

| Marine | Moisture resistance, Coast Guard compliance | Victron, RELiON | Non-marine rated batteries |

Residential solar storage prioritizes inverter compatibility above all else. A battery that doesn't communicate properly with the inverter causes endless frustration regardless of specifications. Budget batteries claiming "universal compatibility" often mean basic parallel connection without intelligent communication. The battery works as a dumb energy reservoir rather than integrated system component.

Off-grid installations add temperature extremes and service access challenges. A Montana cabin at -30°C needs batteries with integrated heating and low-temp charge lockout. When something fails, driving three hours to replace a pack costs more than the battery itself. Victron's full ecosystem makes sense here despite the premium. Remote diagnosis and firmware updates through VRM save truck rolls.

Golf cart applications demand motor surge handling that solar-focused batteries can't provide. Stomping the pedal from a stop spikes current to 400-500A briefly. Solar storage BMS sees that spike and disconnects. Trojan, Allied, Dakota specifically engineer for golf cart abuse. Using a solar storage battery in a golf cart causes nuisance disconnections until the owner gives up.

RV applications stress vibration tolerance and charging flexibility. A battery that works fine stationary fails in six months rattling down dirt roads. Rack-mount form factors assume stable mounting impossible in moving vehicles.

Marine environments add moisture, salt air, and Coast Guard regulations. Batteries must survive spray, high humidity, and corrosive atmosphere. Using non-marine batteries aboard creates both safety and compliance problems.

Temperature: The Hidden Killer

LFP likes 0-45°C. Above that, degradation accelerates roughly with Arrhenius kinetics. Double the rate around 45°C compared to room temp. Four or five times at 55°C. Arizona garage in summer easily hits those numbers during afternoon charging. A pack rated 4,000 cycles at 25°C might deliver a quarter of that cooking through Phoenix summers.

Cold is worse in a different way. Charging below freezing plates lithium on the anode instead of intercalating properly. Single event at -10°C causes measurable permanent damage. RV owners leaving chargers connected during winter storage learn this the expensive way.

Lithium plating creates metallic deposits that reduce capacity permanently and create internal short circuit risk. The damage is cumulative and irreversible. A battery that survives one -10°C charge might fail after the tenth as accumulated plating finally creates a short.

Premium packs include low-temp charge lockout and sometimes heating. Budget packs often skip the lockout and let owners destroy cells unknowingly. BYD and Pylontech implement charge lockout below 0°C. Many sub-$800 batteries don't.

Thermal management separates tiers. Premium batteries distribute temperature sensors across the pack and adjust charge rates based on hottest-cell readings. Budget batteries use a single thermistor stuck near the BMS board rather than the cell stack, which reads lower than actual cell temperatures during high-rate charging.

The thermistor placement problem leads to real damage. BMS sees 35°C on its sensor while actual cell temperature reaches 50°C. No derating occurs because BMS thinks temperature is fine. Cells degrade faster than specifications predict.

| Feature | Premium | Mid-Tier | Budget |

|---|---|---|---|

| Temperature Sensors | 4-8 distributed | 2-3 | 1 |

| Low-Temp Lockout | Yes, with heating option | Usually | Sometimes |

| High-Temp Derating | Gradual reduction | Hard cutoff | Hard cutoff or none |

| Thermal Interface | Proper paste application | Variable | Often missing |

Total Cost: Stop Looking at Sticker Price

What shows up on the invoice is a fraction of actual ownership cost. Cycle life, efficiency losses, replacement timing, installation labor. All of it determines whether a cheap battery actually saves money over a fifteen or twenty year system lifespan.

Efficiency matters more than buyers realize. Good LFP systems return 92-96% of energy put in. The rest becomes heat. Cheap batteries with marginal cells and basic BMS drop into the high 80s. That 5-6 percentage point gap sounds trivial until you multiply it across thousands of cycles over fifteen years.

Replacement timing makes budget batteries expensive over system life. A $700 battery lasting 2,000 cycles costs $0.07/cycle at 50Ah usable. A $1,200 battery lasting 6,000 cycles costs $0.04/cycle. Third replacement of the cheap battery happens around year eight. The expensive battery is still running.

| Factor | Budget ($700) | Mid ($1,200) | Premium ($1,800) |

|---|---|---|---|

| Initial Cost | $700 | $1,200 | $1,800 |

| Expected Cycles | 2,000 | 4,000 | 6,000+ |

| Replacements (10yr) | 1-2 | 0-1 | 0 |

| 10-Year Total | $1,400-2,100 | $1,200-2,400 | $1,800 |

Insurance adds another cost layer. Homeowner's policies increasingly ask about battery installations. Documented UL-certified systems from known manufacturers typically receive coverage without changes. Uncertified systems may require disclosure, premium adjustments, or exclusion.

A fire traced to an uncertified battery could result in claim denial. Homeowner responsible for rebuild costs. Insurance companies have gotten better at identifying battery installations during post-loss investigations. The $300 saved buying uncertified looks different against a denied $400,000 claim.

Where to Buy

Authorized distributors like Signature Solar, altE Store, Solar Electric Supply provide actual warranty support. Solar installers mark up 15-30% but handle claims and installation. Amazon third-party sellers vary from legitimate to sketchy. Alibaba direct looks cheap until customs fees, shipping damage, and zero warranty support get factored in.

The import route attracts bargain hunters but falls apart when something breaks. Shipping damage means international arbitration costing more than the battery. Defects found after unpacking? No realistic recourse. Customs duties and shipping fees close the price gap fast.

Solar installers earn their markup through warranty intermediation. Good installers expedite replacement claims through distributor relationships built over years. Handy types who handle their own installs and warranty paperwork save by going direct to distributors.

Used batteries show up on Facebook Marketplace. Systems pulled during upgrades or home sales, priced at 30-60% of new. Evaluating them properly requires a capacity tester and BMS interrogator. Without equipment and experience reading degradation patterns, buying used means gambling.

Troubleshooting Common Problems

Cell imbalance causes most problems. Capacity drops, low-voltage shutdowns happen early, SOC readings drift from reality. Pull cell-level voltage data from the BMS. Healthy cells sit within 50mV of each other. Over 100mV spread needs attention. Extended absorption charging lets balancing circuits catch up. Bad cases require manually matching cell voltages.

| Symptom | Likely Cause | Fix |

|---|---|---|

| 100% SOC but inverter sees low voltage | Cell imbalance | Full charge-discharge cycle |

| Intermittent comm errors | CAN bus termination | Check for 60Ω across CAN-H/CAN-L |

| Charging stops at partial SOC | Temperature cutoff | Improve ventilation |

| System trips under load | BMS overcurrent | Add parallel batteries |

CAN bus problems create frustrating intermittent faults. Battery works fine isolated, throws errors when connected. Proper termination requires exactly two 120Ω resistors, one at each end. Measure across CAN-H and CAN-L with everything powered off. Should read 60Ω. 120Ω means missing terminator. 40Ω means extra terminator.

Temperature shutdowns increase in extreme climates. Summer charging in hot garages hits BMS limits around 45-55°C. Battery protects itself, users think it's broken. Check BMS temps during fault. Fix involves ventilation, shade structures, or relocating to climate-controlled space.

Capacity fade faster than spec suggests abuse, defect, or spec fraud. Test actual capacity through controlled discharge from 100% to cutoff. Results within 80% of rated capacity fall within normal degradation. Below 80% during warranty period typically qualifies for replacement. Significantly below 80% on new batteries suggests spec fraud or shipping damage.

Poking around inside lithium packs without proper knowledge starts fires. The cells hold enough energy to weld metal. Leave enclosure disassembly to people with experience and equipment.

Where the Market Is Heading

Sodium-ion batteries represent the nearest chemistry shift. CATL announced mass production in 2023, BYD following. Lower energy density than LFP but no lithium/cobalt/nickel supply chain worries. Cold performance beats LFP. Charging at -20°C versus LFP's typical 0°C cutoff. First sodium-ion 48V products appeared in Chinese markets late 2024. Western availability expected by 2026. I'm watching closely.

Solid-state remains further out despite lab progress. Toyota, QuantumScape, startups all have prototypes with double current energy density. Manufacturing challenges persist. Interface resistance problems keep killing scale-up attempts. Commercial solid-state 48V products remain 5-7 years away minimum.

Prices favor patient buyers. Lithium carbonate crashed from $80,000/ton late 2022 to under $15,000/ton mid-2024, driving pack prices down 30-40%. Manufacturing capacity keeps expanding faster than demand. Waiting 12-18 months might get better products at lower prices.

Regulations squeeze budget brands. EU Battery Regulation effective 2027 requires battery passports documenting chemistry, origin, carbon footprint. California considering similar requirements. Premium manufacturers with traceable supply chains benefit. Budget brands using anonymous cells face market access problems as rules tighten.

Buyers with immediate backup needs should purchase proven current-gen products. Buyers planning installations 2+ years out might benefit from watching sodium-ion development and price trends before committing.