This might sound like common sense, but this principle can eliminate 90% of your decision-making struggles. The lowest-priced solution almost always has hidden pitfalls—whether it's air cooling that overheats and throttles power in summer, a supplier with no service team in your market, or poorly integrated BMS and inverter communications that compromise efficiency. The money you save upfront will eventually be paid back in other ways.

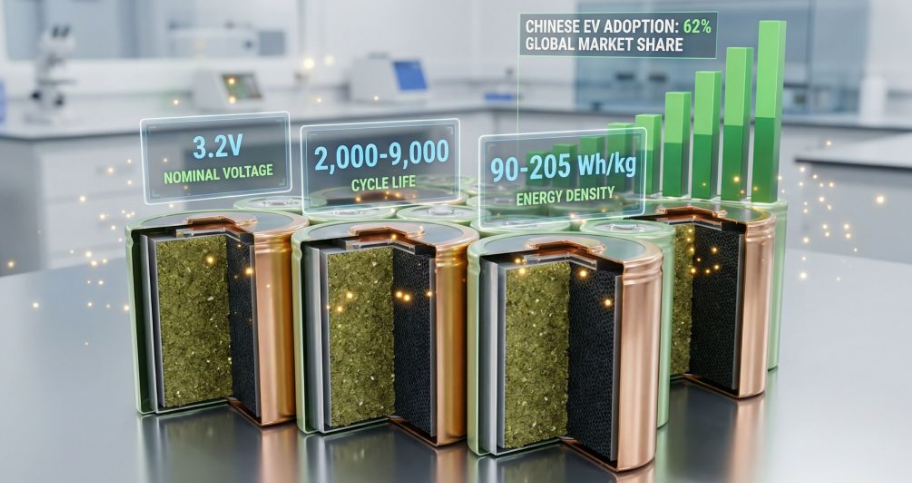

No Need to Hesitate on Voltage and Chemistry

For systems above 500kWh, go with 1500V plus LFP. That's it.

1500V saves copper and reduces losses; LFP offers safety and long lifespan. These two points are no longer debated in the industry. The only question is when to deviate from this default.

NMC is only suitable for one scenario now: when your installation space is so tight that every cubic meter counts. I'm talking about constraints like downtown office building equipment rooms or rooftop weight limitations. If it's just "the factory yard is a bit cramped," some layout optimization can easily fit LFP. Trading energy density for cycle life—that math almost never works out.

400V to 800V low-voltage systems are suitable for small projects. For applications under 200kWh like convenience store backup power or small-scale solar self-consumption, high voltage actually adds complications. Local electricians may have never seen a 1500V cabinet, fire department approvals take extra trips, and compatible components are harder to source.

Wait two more years for sodium-ion. CATL's Naxtra production line won't reach mass production until 2026. Currently available sodium-ion products have limited production capacity, no price advantage, and uncertain after-sales support. Unless your project is in an extremely cold region—we're talking minus twenty-something degrees where LFP heating losses become prohibitive—there's no need to be an early adopter.

LFP (Lithium Iron Phosphate) battery cells offer superior safety and longevity for commercial applications

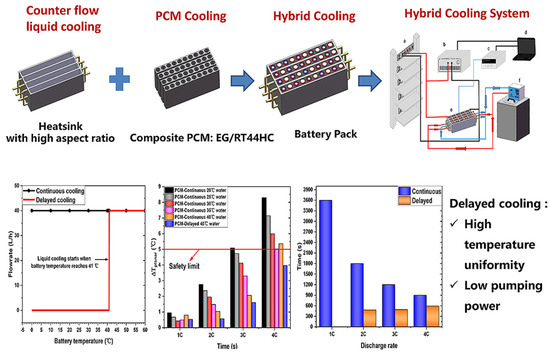

Thermal Management Is Where People Really Get Burned

When suppliers quote you, the price difference between air cooling and liquid cooling looks like about 25%. Many procurement teams think: save that 25%, the batteries will work fine anyway.

The problem shows up five years later. Air cooling can only achieve temperature uniformity of plus or minus 5 degrees. Within the same battery cluster, cells near the air duct run at 25°C long-term while those far from the duct run at 35°C. Lithium battery lifespan is exponentially related to temperature—a 10-degree difference means double the degradation rate. After five years, your system doesn't uniformly degrade to 90% capacity. Instead, some cells are still fine while others are essentially dead. The entire cluster's capacity gets dragged down by those worst-performing cells.

Liquid cooling keeps temperature variance within plus or minus 2 degrees. In the long run, that 25% premium pays for itself through fewer battery replacements.

The only exception is cold climates plus low cycling. In places like Northern Europe or Northern Canada where annual average temperatures are in the teens, and the system is only used for pure backup power with fewer than 100 charge-discharge cycles per year, air cooling is indeed sufficient. But projects meeting both conditions are rare.

I'm writing more about thermal management because this is the most easily overlooked yet most costly selection mistake. Suppliers won't proactively tell you about air cooling's problems—they'll just say "meets design requirements." Design requirements are typically calculated for 25°C ambient temperature, but your factory might hit 40°C in summer. When you push against that boundary, air-cooled systems either trigger over-temperature alarms and shut down, or throttle power output. And when you most need peak shaving is precisely during summer afternoon demand peaks.

Advanced liquid cooling systems maintain optimal temperature uniformity across battery modules

BMS

Just buy branded products. BMS from tier-one manufacturers like CATL, BYD, and LG are all adequate—they have all the necessary features and meet accuracy standards.

The only thing to watch out for is communication protocol integration. Between BMS and inverter, between BMS and energy management system—even though they all claim to use standard protocols, each vendor's implementation details differ. Having the supplier conduct an integration test before signing the contract is more important than any technical specification.

As for balancing strategies, honestly, their impact on actual operation isn't as significant as supplier PowerPoints suggest. Active balancing is slightly better but costs more—choose it for high-cycling projects. Passive balancing is slightly worse but cheaper—it's sufficient for low-cycling projects. Don't spend too much energy on this.

Safety Compliance Depends on Your Target Market

United States

US: UL 9540, UL 9540A, NFPA 855. The 2026 version of NFPA 855 adds explosion protection requirements, following NFPA 69 for deflagration venting or ventilation.

Europe

Europe: CE marking, IEC 62619, IEC 62620. CE certification became mandatory after August 2024. Battery passports required starting 2027.

Nothing particularly difficult to understand—just a checklist of compliance items. Find an experienced certification agency to handle it; researching the standards yourself wastes time.

Germany's grid connection queue is a real trap. There's currently a backlog of over 500GW in applications, and waiting three years for new projects is normal. If you're doing the German market, you must factor in this timeline—don't buy equipment only to discover you can't connect to the grid.

Supplier Selection Reflects Your Risk Appetite

CATL and BYD quote 20% to 30% lower, and the equipment quality itself is fine, but their after-sales systems in Europe and North America aren't mature yet. When something breaks, waiting two to three weeks for an engineer to fly in from China or for parts to ship from Shenzhen is normal.

Tesla and Fluence are expensive—what you're paying for is service and bankability. Megapack comes with a 15-year full-wrap warranty and global response teams. More importantly, when you take Tesla equipment to do project financing, banks can offer interest rates one to two percentage points lower. On large projects, the money saved on financing costs might exceed the equipment premium.

LG and Samsung are in the middle. Stable quality, production lines and service networks in both Europe and North America, and they meet IRA domestic content requirements. About 15% cheaper than Tesla, better service than Chinese manufacturers.

If your technical team is strong, can handle O&M independently, and doesn't need project financing, Chinese equipment paired with local outsourced service providers is the most cost-effective solution. Without these conditions, just spend more for peace of mind.

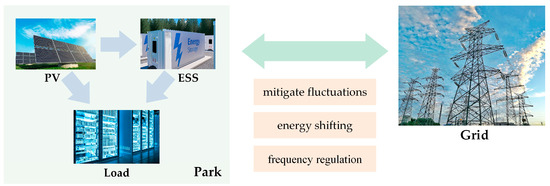

Revenue Stacking Determines Payback Speed

For pure peak-shaving projects, the system only runs a few hundred hours per year, making payback periods quite long.

To shorten payback, you need to stack other revenue streams. Peak-valley arbitrage (charge at night, discharge during the day), grid frequency regulation ancillary services, backup power insurance value—these can all be done simultaneously. In the PJM market, some projects derive over 80% of their revenue from frequency regulation rather than peak shaving.

The US currently offers 30% investment tax credit through the IRA, which can exceed 50% when combined with domestic content requirements and energy community provisions. However, projects breaking ground after the end of 2025 face Chinese component restrictions, and construction must begin before July 2026 to receive full subsidies. If you want to do this, move fast.

European subsidies vary by country. Germany has VAT exemption, Italy has a 50% tax credit dropping to 36% in 2027, and Austria directly provides 200 euros per kWh.

Revenue stacking through multiple services significantly accelerates project payback periods

Don't Over-Engineer

Energy storage is a fifteen-year business. During selection, it's easy to get lost in technical specification rabbit holes, agonizing over that 2% efficiency difference or that 5% price difference.

These differences matter less than reliability and service. A simple, mature, easy-to-maintain system will likely deliver better actual returns over fifteen years than a system with impressive specs but higher complexity.

Coming back to where we started: don't cheap out. This principle is more useful than any technical analysis.