Demand charges are the most absurd design element in American commercial electricity pricing.

The utility company looks at the highest 15-minute peak on your usage curve each month. Regardless of how that peak occurred, how long it lasted, or how many times it happened in a month, they multiply that number by a rate and charge you a fee. It's called a demand charge. This fee is often more expensive than the actual electricity you consumed.

A factory might run steadily at 400 kilowatts all month long, but on Monday morning when operations start up, the compressors, motors, and air conditioning all kick on simultaneously, spiking to 800 kilowatts for 20 minutes. Those 20 minutes determine the entire month's demand charge. If the rate is $25 per kilowatt, that's $20,000 for this single line item. Next month, the same thing happens again.

What battery storage does is simple: it discharges when the load is about to spike, pushing that peak down. The meter sees a peak of 500 instead of 800, and the demand charge drops from $20,000 to $12,500. That's $7,500 saved per month, $90,000 per year.

This is the hardest logic behind commercial energy storage. It's not about green energy sentiment or carbon neutrality KPIs—it's real money disappearing from your bill. In areas with high demand charge rates, storage projects almost always pencil out. In areas with low rates, unless there are other revenue sources, it's difficult to make the numbers work. California, New York, Hawaii—rates regularly hit $20-30 per kilowatt, making projects easy. Texas, the Southeast—under $10, making projects difficult. It's that simple.

Battery Chemistry: A Settled Debate

There's nothing left to discuss about battery chemistry. Lithium iron phosphate (LFP) has won.

Five years ago, people debated whether NMC (nickel manganese cobalt) batteries had higher energy density and whether LFP was too bulky. Nobody argues anymore. Over 70% of stationary storage now uses LFP. The reasons are straightforward: NMC can catch fire, LFP essentially doesn't. NMC degrades after three to five thousand cycles, LFP still has 80% capacity after six thousand cycles. Commercial storage systems are installed next to office buildings, inside warehouses, near valuable equipment—nobody wants to risk a fire. Cycle life directly determines when you need to replace the batteries, and replacement costs can eat up all the profits from the first several years.

NMC's only advantage is higher energy density—smaller volume for the same capacity. For electric vehicles, this matters because it directly affects driving range. For commercial storage, the system sits in a corner of the parking lot; whether you use a 40-foot or 20-foot container, site costs don't differ much. Taking on fire risk and early battery replacement just to save some space isn't worth it.

Software Matters More Than Hardware

Software is more important than hardware, but few people seriously evaluate software.

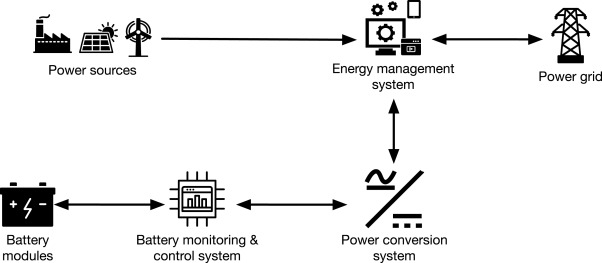

Two systems with identical hardware specifications can differ by 30% in actual financial returns. The difference lies in control strategy. A simple controller does one thing: discharge when load is high. A smart energy management system predicts load, tracks electricity prices, participates in demand response, and coordinates multiple revenue streams. Should you empty the battery in the morning to capture some time-of-use arbitrage, or save capacity for afternoon peak shaving? This trade-off happens every day, and whether the algorithm does it well shows up directly on your bill.

Two systems with identical hardware specifications can differ by 30% in actual financial returns. The difference lies in control strategy.

Many buyers spend enormous effort comparing battery specs but gloss over software. They ask the vendor for a demo, look at the interface, think it seems professional, and consider the evaluation done. Six months into actual operation, they discover the system is optimizing against outdated rate schedules, or the prediction algorithm is simply inaccurate, failing to discharge when it should and discharging when it shouldn't.

When selecting vendors, you should ask clearly: How often is your rate database updated? What's your load prediction algorithm based on? Have you run backtests to verify prediction accuracy using historical data? Most vendors can't answer these questions.

Federal Tax Credits: A Complete Rewrite

Federal tax credits have completely rewritten project economics.

Before the Inflation Reduction Act, storage had to be paired with solar to qualify for credits. Now standalone storage qualifies too—30% base credit, plus domestic content bonus, energy community bonus, and low-income community bonus, up to 70% maximum. A $1 million project with a 50% credit has an actual cost of $500,000. Add five-year accelerated depreciation, and the after-tax cost might be only 30-40% of the sticker price.

This has changed the entire industry's math. Previously marginal projects are now attractive; previously attractive projects are now no-brainers. But credit provisions are complex, and meeting conditions requires thinking. Domestic content bonus requires 100% domestic steel and over 45% domestic manufactured products (rising to 55% in 2027). With 98% of LFP cell production capacity in China, figuring out how to meet domestic content ratios is a technical exercise. Energy community bonus requires projects in specific locations—coal transition areas, fossil fuel employment-dependent areas. There are online maps to check, but many projects don't consider this during site selection.

State-level incentives vary even more. California's SGIP general market budget is exhausted, but the equity budget remains open—disadvantaged community projects can receive $1,000 per kWh, basically covering the entire installation cost. New York gives disadvantaged community projects $350 per kWh. Massachusetts has demand response subsidies of $275 per kW per year; stacked with utility rebates, project returns can double.

The problem is these programs have limited budgets and changing rules. This year's open window might close next year. Last year's terms might tighten this year. Tracking policy changes is itself a specialized skill, and many project developers stumble here.

Permitting: The Unpredictable Bottleneck

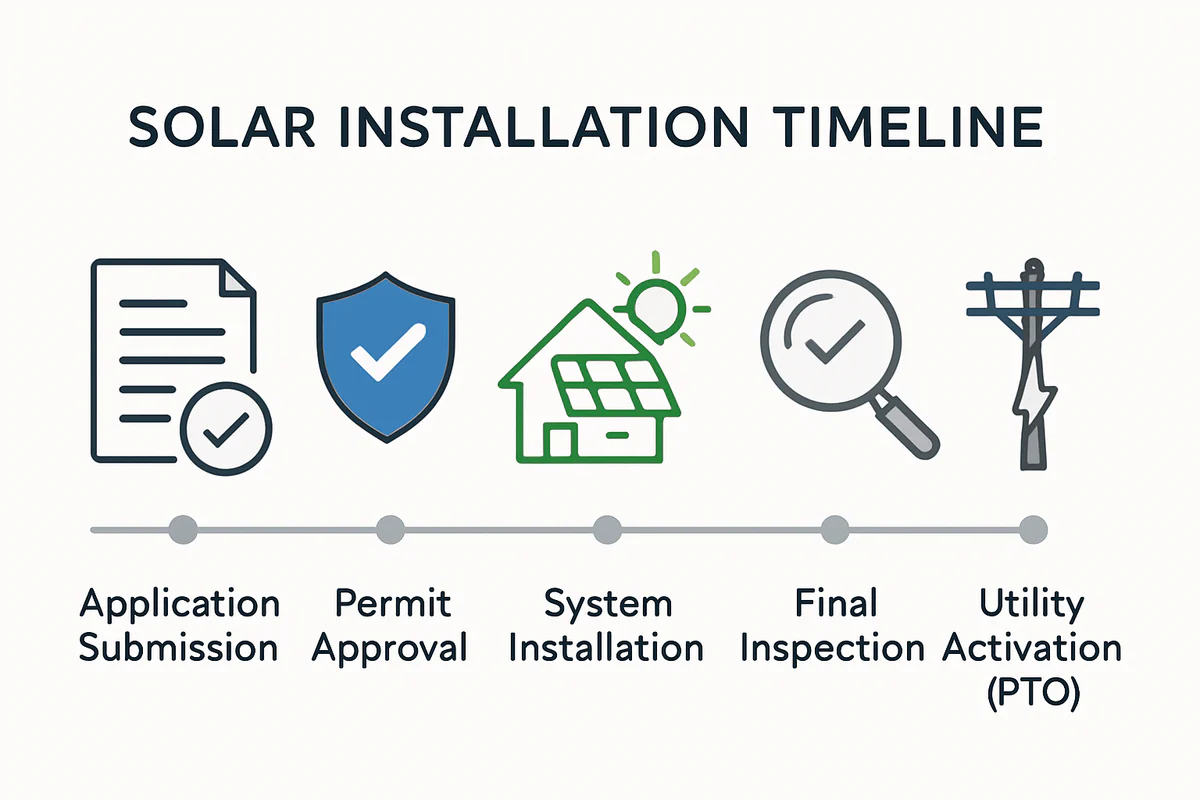

Permitting approval is the most unpredictable phase.

The system itself installs quickly—container-based units, crane sets it down, connect the wires, done in days. But before that, you need building permits, electrical permits, fire permits, and utility interconnection approval. Each stage can get stuck.

Fire is the most troublesome. Requirements vary enormously between cities. Some require UL 9540A thermal runaway test reports, some require additional fire suppression systems, some fire officials have never seen a storage project and don't know what to review, going back and forth for months. Some projects spend more time on fire approval than all other phases combined. Recommendation: visit the fire department during site selection to understand what they require before proceeding with anything else.

Utility interconnection queues are another pitfall. Over 2,600 gigawatts of projects nationwide are queued waiting for studies, with median wait times stretching to several years. Commercial-scale projects generally fare better than large utility-scale plants, but you can't expect it to be done in weeks. Behind-the-meter systems that don't export to the grid get approved faster. If you want to participate in demand response or provide grid services, you need engineering studies, and timing is unpredictable.

Warranty Terms: Read Every Word

Warranty terms need to be read word by word.

"Ten years, 70% capacity retention" sounds straightforward.

Some warranties are calculated by years, others by cycle count, whichever comes first. A ten-year warranty with a 4,000-cycle limit—if your system cycles 1.5 times daily, you'll exhaust the allowance in six or seven years. Some warranties have operating temperature requirements; exceed the range and the warranty is void. Some require using the manufacturer's designated energy management system; switch to different software and you lose coverage. Some only cover parts, not labor; when replacing batteries, you pay for installation yourself.

A startup might offer attractive warranty terms, but whether they'll still exist in year eight to honor their commitments is questionable.

The financial condition of the warranty provider also matters. Startups might offer attractive warranty terms, but whether they'll still exist in year eight to honor their commitments is questionable. Companies with the scale of CATL or BYD have lower flight risk. A startup valued at a few tens of millions of dollars is uncertain.

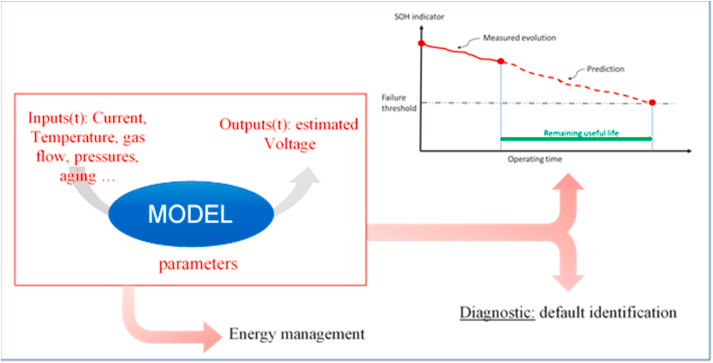

Degradation Curves: The Hidden Variable

Degradation curves directly impact project returns.

Batteries don't suddenly fail one day; they gradually worsen year by year. Calendar aging consumes 1-2% capacity annually; cycle aging takes a bit with each charge-discharge cycle. Higher temperatures, deeper discharges, faster charging—degradation accelerates. Better temperature control, shallower discharges, slower charging—degradation slows.

This means if a system is designed to still deliver rated capacity in year ten, it needs to be oversized in year one. Install 2.2 MWh of equipment, sell 2 MWh to the customer; after ten years of degradation to 80%, you still meet the contract. Alternatively, don't oversize but plan to add capacity in years seven or eight. The two approaches have completely different cash flow profiles.

There's another thing many people don't consider: the battery reaching end of warranty isn't the end. What can a system at 70% capacity still do? Either continue using it with lower efficiency, sell it to the secondary market for less demanding applications, or recycle it to extract materials. Each path has value, but none happens automatically—all require advance planning.

The Window Is Narrowing

The window is narrowing.

Battery prices have dropped 40% over the past two years, now just over $70 per kWh. How long this price will last is uncertain. Chinese production capacity accounts for 98% of global supply, with tariffs fluctuating between 54% and 100%. U.S. domestic capacity is expanding but volumes haven't ramped up yet. It might take three to five years for the domestic supply chain to mature; prices and supply will be unstable in the interim.

How long federal credits will last is also uncertain. This is legislation-driven; the next Congress can modify or abolish it. Domestic content requirements are tightening annually—45% in 2025, 55% in 2027. Terms available now may not exist next year.

State program budgets are depleting. California's general market allocation is gone. Other states are heading that way. Early entrants eat the meat, latecomers get the soup, arrive even later and you're just watching.

Waiting has no upside. Delaying a year won't bring better conditions; you'll just watch the window narrow. Today's prices, today's policies, today's rate structures—stacked together, they create an opportunity window that won't last long.