What Are Lithium Battery Cells?

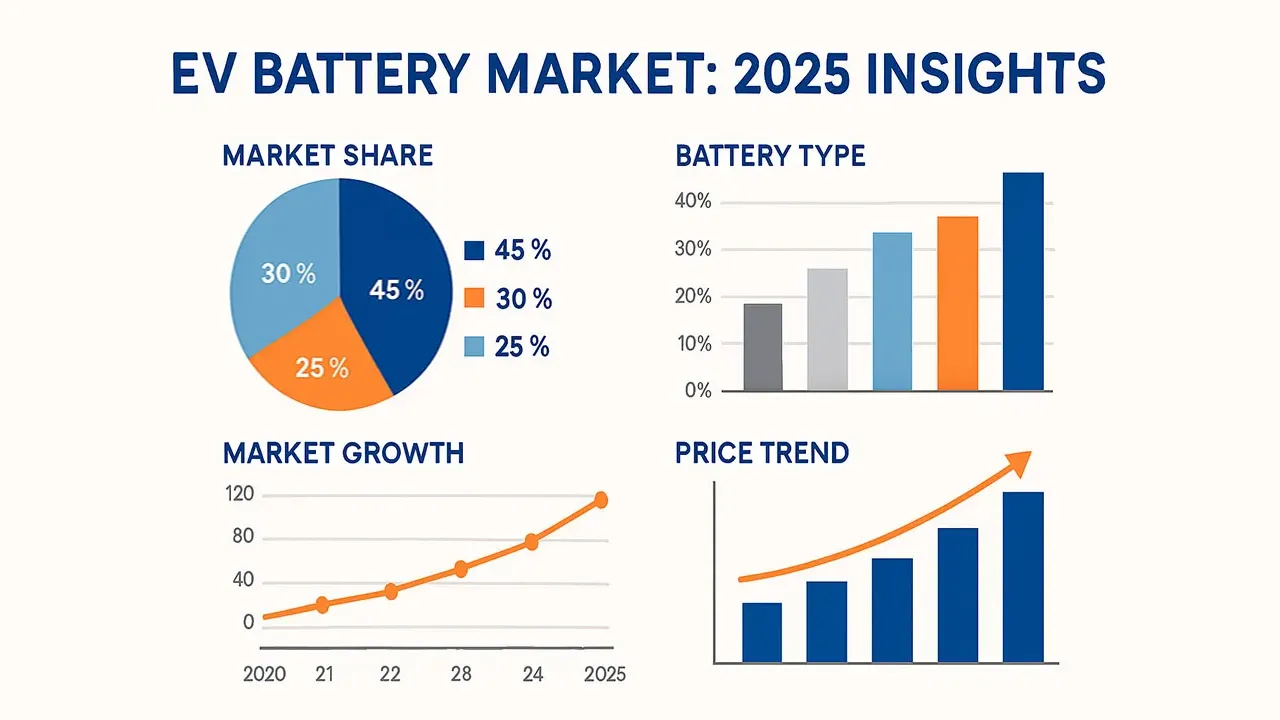

Lithium battery cells form the backbone of modern energy storage, powering electric vehicles, grid-scale installations, and virtually every portable electronic device. The global market surpassed $75 billion in 2024, a figure that becomes more striking when compared to the $11 billion valuation recorded in 2012.

Why lithium-ion dominates comes down to a convergence of favorable properties. Energy densities reaching 300-330 Wh/kg place lithium-ion far ahead of older chemistries like lead-acid and nickel-metal hydride. Operational lifespans exceeding 3,000 charge cycles transform these cells from consumables into durable capital equipment. The absence of memory effects permits flexible charging regimes that accommodate real-world usage patterns. Underlying all of this, the intercalation mechanism enables such performance without violent chemical reactions.

The Building Blocks Behind Modern Energy Storage

Every lithium-ion battery pack reduces to individual cells functioning as coordinated electrochemical units. Understanding these cells requires examining five components whose interactions determine every measurable performance characteristic.

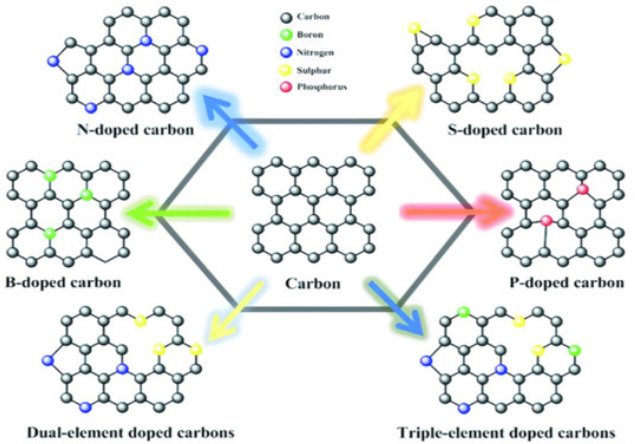

Graphite dominates commercial anode production, and for reasons that extend well beyond simple economics. This crystalline carbon allotrope creates galleries between hexagonal carbon sheets where lithium ions reside during charged states. When discharge begins, these ions abandon the galleries and migrate toward the cathode, liberating electrons that flow through external circuits. Graphite's suitability stems largely from its dimensional behavior during cycling: 10% volumetric expansion occurs between fully lithiated and delithiated states. Compared to alternative materials that suffer mechanical fatigue and electrode cracking, graphite maintains structural integrity over thousands of cycles. The low electrochemical potential of lithiated graphite also maximizes cell voltage, directly boosting energy density.

Lithium ions occupy specific staging configurations during intercalation, minimizing electrostatic repulsion rather than filling available spaces randomly. Observable through voltage plateaus during charging, this staging behavior reflects thermodynamic optimization occurring within each cell. The phenomenon was first systematically described by Daumas and Hérold in 1969 while studying graphite intercalation compounds with alkali metals, though the relevance to battery applications would not become apparent for another two decades.

Before continuing with cathode materials, the separator deserves attention—not because of logical sequence, but because separator failures have caused more public relations disasters than any cathode chemistry debate ever will.

A thin polymer membrane sits between the electrodes. Polyethylene or polypropylene at 20-25 micrometers thickness, this microporous layer performs contradictory tasks: preventing electrode contact while permitting ionic transport.

Engineering separators requires compromise. Larger pores reduce ionic resistance but increase dendrite penetration risk, while smaller pores improve safety margins but impede lithium-ion mobility. Commercial separators achieve porosities of 40-60% with pore diameters in the sub-micron range.

At 130°C, polyethylene separators melt and collapse their pore structure, halting ionic transport before temperatures trigger thermal runaway. Engineers designed this behavior intentionally as a safety mechanism. Trilayer separators sandwich polyethylene between polypropylene layers, providing staged protection, while ceramic coatings raise thermal stability further and improve wettability. Dendrites can puncture separators and create internal short circuits, generating heat that propagates through neighboring regions. Separator development focuses increasingly on dendrite resistance through ceramic reinforcement and crosslinked polymer structures, though no current solution eliminates this risk entirely.

Silicon presents a fascinating case study in the gap between theoretical promise and practical reality. Theoretical capacity approaches ten times that of graphite. Beaulieu et al. documented in the Electrochemical and Solid-State Letters (Vol. 4, Issue 9, pp. A137-A140, 2001) that silicon swells beyond 300% during lithiation, pulverizing electrode structures within dozens of cycles. Current commercial implementations blend silicon nanoparticles or silicon oxide into graphite matrices, capturing partial capacity gains while maintaining structural integrity. The 2024-2025 generation of high-energy cells incorporates 5-15% silicon content. Pure silicon anodes have failed to achieve commercial viability despite two decades of research investment, and the fundamental mechanics of volumetric stress suggest this barrier may prove insurmountable.

The cathode receives the most attention from researchers and manufacturers because it determines fundamental cell characteristics more than any other component. Commercial cathodes share a common operating principle: lithium ions insert into and extract from crystalline host structures during cycling. Crystal geometry, electronic conductivity, and thermodynamic stability of the host material govern performance boundaries.

Three major architectures have emerged in commercial production. Lithium cobalt oxide, which Sony commercialized in 1991 based on Goodenough's breakthrough at Oxford, adopts a layered structure where lithium ions shuttle between cobalt oxide sheets. The original 1980 paper in Materials Research Bulletin (Vol. 15, pp. 783-789) laid theoretical groundwork, though practical implementation required Yoshino's work on carbon anodes at Asahi Kasei before commercialization became feasible. Lithium iron phosphate employs an olivine framework with one-dimensional lithium diffusion channels. Nickel manganese cobalt oxides modify the layered architecture with mixed transition metals, enabling tunable performance characteristics.

The voltage at which lithium ions insert and extract determines cell energy density to a substantial degree. Cobalt-based cathodes operate at 3.9V versus lithium; iron phosphate cathodes plateau at 3.4V. This half-volt difference compounds across every ion movement, and LFP cells store less energy per unit mass despite competitive lithium capacity as a direct consequence. The voltage gap reflects a thermodynamic reality rooted in crystal chemistry and cannot be engineered away. Electronic conductivity in LiFePO₄ sits six orders of magnitude lower than layered oxides, necessitating carbon coating and nano-sizing to achieve practical rate capability. Chung et al.'s 2002 Nature Materials paper (Vol. 1, pp. 123-128) claimed that controlled doping could enhance this conductivity dramatically, though subsequent researchers questioned these results and the controversy remains partially unresolved. A 2004 response by Ravet et al. in the same journal attributed the observed improvements to carbon contamination rather than lattice doping. NMC materials conduct electrons more readily, enabling thicker electrodes and higher power outputs without such extensive processing.

Nickel-rich formulations have dominated the cathode development trajectory over the past decade for applications demanding maximum range. This path introduces complications: higher nickel content correlates with reduced thermal stability and more demanding manufacturing tolerances. The industry consensus that nickel-rich cathodes represent the inevitable future has begun facing scrutiny as LFP improvements close the energy density gap faster than anticipated.

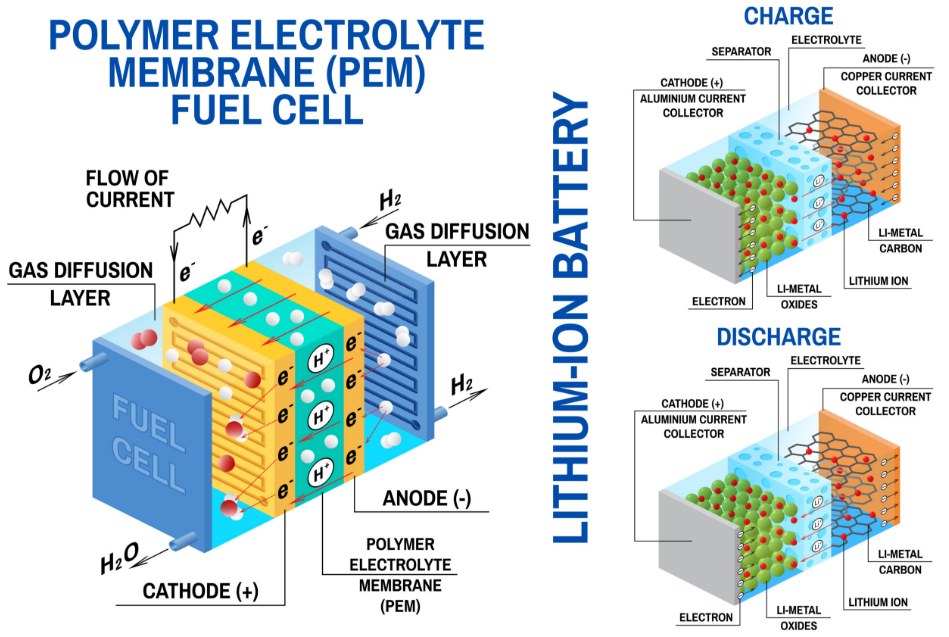

The primary safety limitation of current lithium-ion technology stems from electrolyte flammability. This problem has resisted solution since commercial introduction despite enormous research investment. Commercial cells employ lithium hexafluorophosphate dissolved in organic carbonate solvents, consisting of mixtures of ethylene carbonate, dimethyl carbonate, and diethyl carbonate. This solution carries lithium ions adequately for most applications, though conductivity remains 100 times lower than aqueous electrolytes.

Electrolyte formulation involves balancing competing requirements. Ethylene carbonate provides excellent lithium-ion solvation and contributes to solid electrolyte interphase formation but freezes at 36°C, limiting low-temperature performance. Linear carbonates lower viscosity and extend the liquid range but offer poorer solvation. Commercial electrolytes blend these components in ratios optimized for specific applications. Peled first characterized the solid electrolyte interphase formation mechanism in the Journal of the Electrochemical Society (Vol. 126, pp. 2047-2051, 1979), with subsequent decades of research elaborating the details. During initial charging, electrolyte components decompose at the anode surface, forming a passivating layer that prevents further electrolyte degradation while remaining permeable to lithium ions. Poorly formed SEI allows continued electrolyte consumption, depleting lithium inventory and increasing cell impedance. Aurbach et al. discovered that additives like vinylene carbonate template SEI formation, creating more stable passivation layers. This discovery transformed commercial electrolyte design and now appears in virtually every high-performance cell formulation.

Organic carbonates ignite readily when exposed to air and heat, providing fuel for thermal runaway events. This fundamental limitation has motivated solid-state electrolyte research for three decades, yet without commercial breakthrough.

The gap between laboratory demonstrations and manufacturing reality remains stubbornly wide.

Current collectors receive less attention despite constraining cell design in important ways. Copper foil serves the anode; aluminum foil serves the cathode. Copper resists lithium alloying at low potentials where the anode operates, while aluminum's native oxide layer protects against corrosion at high cathode potentials. Trade-offs emerge in foil thickness decisions between reducing inactive mass and maintaining manufacturability. The choice of copper over other conductive metals deserves more examination than it receives. Nickel and stainless steel both offer theoretical advantages in certain voltage windows, and early researchers at Moli Energy explored these alternatives before copper became the default standard through a combination of cost considerations and manufacturing inertia rather than pure electrochemical optimization.

Chemistry Variations: LFP's Resurgence and NMC's Dominance

Iron phosphate cathodes trade energy density for exceptional safety margins and cycle longevity. The cost structure for this chemistry has undergone dramatic transformation. Through vertical integration and manufacturing scale, Chinese manufacturers drove cell prices to $53/kWh by late 2024. LFP captured two-thirds of Chinese EV battery installations in 2024, with growing adoption in Western markets. The speed of this shift caught many Western automakers off guard.

Strong phosphate bonds in the olivine crystal structure resist oxygen release even under severe abuse conditions—thermal stability studies at Argonne National Laboratory demonstrated onset temperatures exceeding 250°C. Ford's 2023 announcement of an LFP battery plant with CATL licensing represented a striking reversal from the company's previous nickel-focused strategy, though the political complications of that partnership continue to generate friction.

Grid storage installations exploit the durability advantage of LFP cells, which routinely deliver 4,000-6,000 full cycles while maintaining 80% capacity. Electric vehicle designers face direct trade-offs from energy density limitations. LFP packs delivering equivalent range weigh 25-30% more than NMC alternatives. Pack-level innovations partially offset this penalty through architectural improvements that reduce inactive material.

The flat voltage profile creates state-of-charge estimation challenges. Simple coulomb-counting approaches lack sufficient resolution. Advanced systems address this through impedance spectroscopy and machine learning algorithms, though accuracy still lags behind NMC-based systems.

NMC cathodes blend nickel, manganese, and cobalt in ratios that tune performance characteristics. Boosting nickel content increases capacity; the trade-off manifests in reduced thermal stability and more demanding manufacturing tolerances. Dahn's research group at Dalhousie University has published extensively on NMC degradation mechanisms, providing much of the scientific foundation for current commercial formulations. The group's 2016 paper in the Journal of the Electrochemical Society (Vol. 163, Issue 7, pp. A1348-A1360) established single-crystal NMC as superior to polycrystalline variants for long-term cycling stability. This finding reshaped cathode manufacturing approaches across the industry.

Energy densities of 200-280 Wh/kg become achievable depending on formulation. High-nickel variants push toward the upper end of this range. NMC dominates among Western automakers who prioritize range metrics in markets where charging infrastructure remains sparse.

Higher nickel content increases thermal management demands. Active liquid cooling adds system complexity accordingly. Thermal runaway thresholds drop as nickel increases. Depth of discharge, charging rate, and temperature exposure all influence degradation trajectories. Cycle life spans 1,000-2,000 full cycles depending on operating conditions. Conservative operation extends service life substantially—maintaining 20-80% state of charge and limiting fast charging explain why vehicle software enforces operating envelopes.

Supply chain vulnerabilities from cobalt content have received slow public acknowledgment from the industry. Over 70% of global cobalt production originates in the Democratic Republic of Congo, where artisanal mining operations have documented child labor and unsafe working conditions. Amnesty International's 2016 report "This Is What We Die For" named specific electronics and automotive companies in the supply chain, accelerating corporate responses that had been notably absent despite years of available documentation. The shift toward lower-cobalt formulations reflects both cost pressures and ethical considerations that major automakers downplayed until investigative journalism forced acknowledgment.

Other chemistries occupy narrower niches. NCA substitutes aluminum for manganese, creating cathodes with the highest specific energy among mature commercial chemistries. Tesla's consistent NCA selection for premium models reflects the chemistry's range advantages, though exothermic reactions initiate at lower temperatures than both LFP and NMC. Lithium titanate replaces graphite in LTO battery anodes, enabling extremely fast charging rates, operating temperatures spanning -40°C to 55°C, and cycle life exceeding 15,000 cycles. Energy density suffers considerably at only 70-80 Wh/kg. Bus rapid transit systems constitute the chemistry's natural application, where Toshiba's SCiB battery line targets these deployments. Adoption remains restricted to applications where unique advantages justify the penalties.

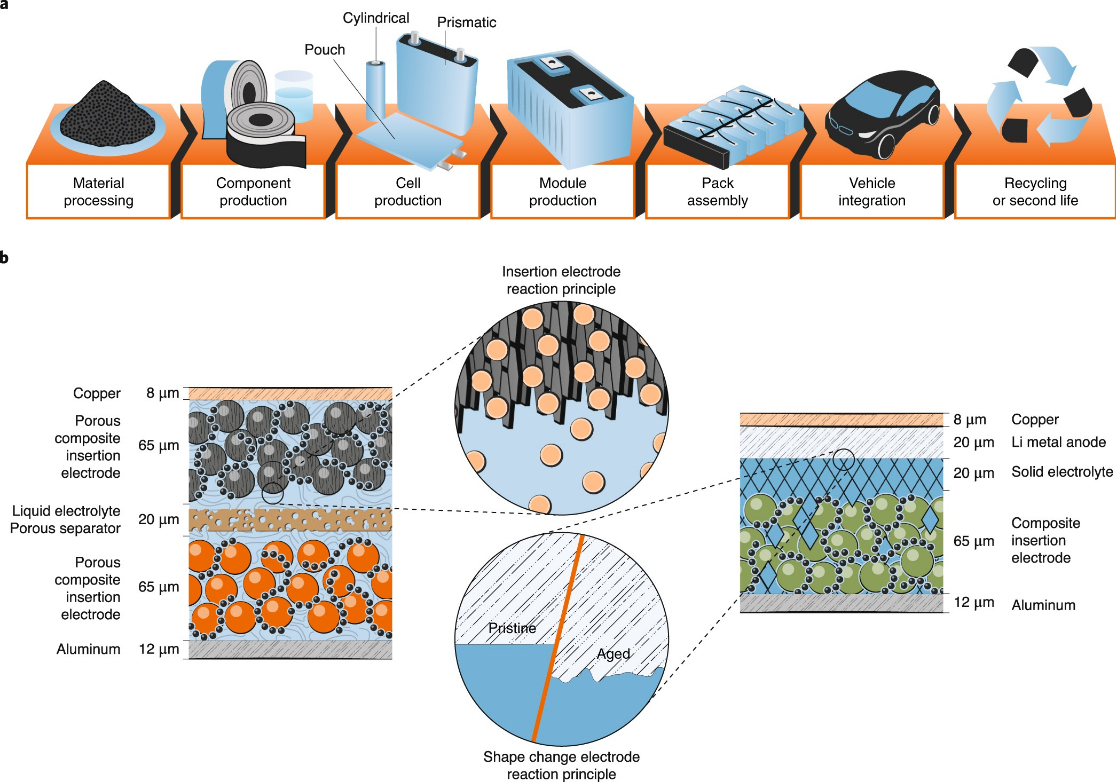

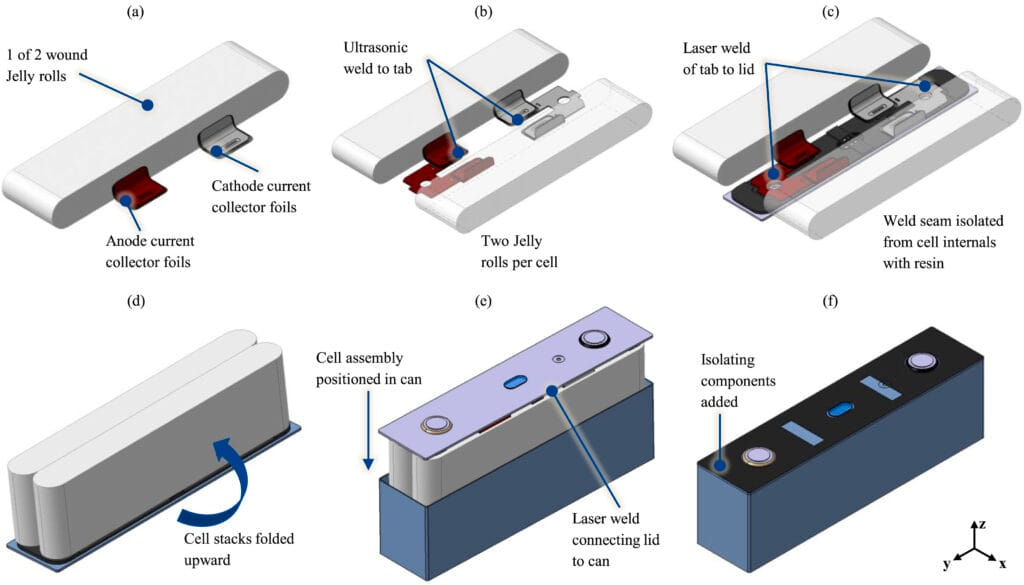

Cylindrical Cells and Their Competitors

Lithium battery cells manifest in three distinct physical configurations. Metal cans house electrode assemblies in cylindrical cells, with dimensional encoding following industry convention: 18650 cells measure 18mm diameter by 65mm length; 21700 cells measure 21mm by 70mm; the emerging 46800 format spans 46mm by 80mm. Internal pressure distributes uniformly across curved surfaces, preventing localized stress concentrations. Rigid metal housings withstand vibration, impact, and thermal cycling, while pressure relief vents provide controlled failure modes during thermal events.

Cost leadership follows from manufacturing maturity. Production processes refined over three decades achieve yields exceeding 99%. Chinese manufacturers pushed costs below $60/kWh at cell level in 2024. Automated winding equipment processes electrode materials into jellyroll assemblies at speeds approaching 80 meters per minute in the most advanced facilities.

Tesla's format evolution illustrates the trade-offs involved. The original Roadster employed thousands of laptop-grade 18650 cells, an approach that drew skepticism from established automakers who viewed the architecture as fundamentally unserious. Subsequent models reduced cell count while increasing pack capacity through larger formats and higher-energy chemistry. The 4680 cells announced in 2020 promise further consolidation, though Tesla's tabless electrode design has yet to demonstrate promised manufacturing simplifications at scale, with production yields reportedly lagging targets through early 2025.

Round profiles leave interstitial voids when arranged in rectangular battery compartments. This packing inefficiency remains the cylindrical format's principal limitation. For smartphones and ultrabooks, the inefficiency proves disqualifying.

A brief detour into manufacturing economics: the assumption that larger cells always reduce costs deserves scrutiny. Yield rates for 4680 cells at Tesla's Texas facility remained below 80% through most of 2024, compared to 99%+ yields for mature 21700 production.

The math on cost-per-kWh becomes considerably less favorable when accounting for scrap rates, yet investor presentations rarely acknowledge this complexity.

Rectangular geometries in prismatic cells maximize space utilization. Flat-sided aluminum or steel housings stack efficiently, eliminating interstitial waste. Individual cell capacities span a wide range, with automotive prismatic cells delivering between 100 and 150 Ah, consolidating energy that would require dozens of cylindrical cells. CATL's cell-to-pack designs eliminate module-level packaging entirely, mounting prismatic cells directly into structural battery enclosures. Thermal management challenges arise from concentrating more energy in smaller volumes, and electrode stacks within prismatic housings swell as lithium intercalates, generating internal pressures that stress enclosure seams.

Pouch cells abandon rigid enclosures entirely, achieving gravimetric energy densities 10-15% higher than equivalent prismatic designs through minimalist packaging. Heat generated within electrode stacks conducts rapidly to external surfaces due to high surface-to-volume ratio. Laminate pouches offer negligible puncture resistance, and without rigid constraints, pouch cells balloon progressively during cycling. The format found early success in consumer electronics and has gained automotive traction through Volkswagen's partnership with SK Innovation and GM's Ultium platform, though the 2023 Bolt EV recall involving LG pouch cells highlighted vulnerability to manufacturing defects that might prove more forgiving in rigid housings.

2025 Market Dynamics and Technology Trajectories

Growth rates approaching 20% annually continue in the lithium battery cell market, driven by electric vehicle adoption and renewable energy storage deployment.

Limited commercial production of solid-state batteries began in 2024-2025. NIO's semi-solid-state pack achieves 360 Wh/kg while enabling significantly faster charging. This represents a genuine advancement over liquid electrolyte systems. The cells replace flammable liquid electrolytes with ceramic, polymer, or sulfide solid conductors. Solid electrolyte non-flammability eliminates the primary safety constraint limiting current energy density—removing flammable components permits thinner separators, enables lithium metal anodes with much higher theoretical capacity, and allows operation at elevated temperatures.

Toyota's sulfide solid-state program targets 500 Wh/kg with production timelines extending to 2027-2030. Toyota first announced imminent solid-state breakthroughs in 2017, then again in 2019 and 2021, each time pushing timelines further into the future. This pattern suggests treating announced dates as aspirational rather than concrete.

Solid electrolytes require processing techniques differing fundamentally from liquid electrolyte cell production. Hot pressing, sintering, and atmosphere control cannot be performed in existing gigafactories. Equipment investments measured in billions of dollars must precede volume production. Janek and Zeier outlined these challenges comprehensively in their 2016 Nature Energy perspective (Vol. 1, Article 16141); the field has made incremental progress without fundamental breakthroughs since. Interface resistance between solid electrolytes and electrode materials remains far higher than liquid alternatives, proving more stubborn than early optimists predicted.

The timeline uncertainty around solid-state commercialization has created a peculiar dynamic in battery research funding. Graduate students beginning solid-state electrolyte projects in 2015 were told commercialization was five years away. Those same researchers, now holding faculty positions, tell their own students the same thing.

Whether this reflects genuine optimism or institutional momentum remains an open question that conference presentations carefully avoid addressing.

QuantumScape's 2025 delivery of B-sample cells to Volkswagen PowerCo demonstrates progress toward automotive-grade solid-state technology. Production cost trajectories suggest solid-state cells may achieve parity with liquid electrolyte equivalents by 2029-2031, contingent on manufacturing yields improving dramatically. Many analysts consider this assumption optimistic given historical precedent.

Gigawatt-hour-scale production of sodium-ion batteries began during 2024, offering substantial cost reduction through abundant sodium resources. Sodium ions substitute for lithium throughout the cell: hard carbon anodes, Prussian blue or layered oxide cathodes, sodium salt electrolytes. Current energy density reaches 140-160 Wh/kg, adequate for stationary storage and entry-level electric vehicles where cost dominates over range. BYD's Seagull city car employs sodium-ion cells, targeting aggressive price points, while CATL's sodium-ion product line addresses grid storage applications where lithium price volatility creates budget uncertainty. Stable operation at -40°C gives sodium-ion an edge in cold climates where lithium-ion capacity drops substantially.

China maintains commanding manufacturing dominance, producing 78% of global lithium battery cells in 2024. This concentration creates supply security concerns that Western policymakers largely ignored throughout the 2010s despite warnings from industry analysts and strategic planners. Geographic diversification now accelerates through regulatory responses. The European Union's New Battery Regulation requires carbon footprint disclosure and high recycling rates by 2030. United States Inflation Reduction Act provisions link EV tax credits to domestic battery content requirements reaching 80% by 2027. Chinese manufacturers respond by establishing production facilities in target markets. CATL's Hungarian plant, EVE Energy's European expansion, and announcements targeting US production reflect strategic positioning.

The recycling infrastructure question looms larger than most industry roadmaps acknowledge. Current lithium-ion recycling recovers perhaps 5% of end-of-life batteries globally. The remaining 95% enters landfills, informal recycling operations with minimal environmental controls, or storage awaiting economically viable processing. Projections of circular battery economies by 2035 assume recycling capacity scaling that has no historical precedent in any comparable materials industry.

Application-Specific Selection Criteria

Choosing appropriate lithium battery cells requires matching technical specifications to application requirements. Total energy needs follow from power consumption and runtime requirements through straightforward arithmetic. A device drawing 500W continuously for 2 hours requires 1,000 Wh storage capacity. Accounting for depth-of-discharge limits and system inefficiencies suggests 1,300-1,400 Wh nameplate capacity.

Energy applications differ from power applications in ways that guide cell selection. Energy cells optimize for capacity, delivering sustained output at moderate discharge rates; power cells optimize for current delivery, supporting high-rate bursts. Mismatching cell type to application accelerates degradation.

Chemistry selection faces constraints from operating temperature ranges. LFP maintains strong capacity across a wide temperature range with graceful degradation beyond those limits. NMC and NCA lose significant capacity in cold conditions and degrade faster at elevated temperatures. LTO operates across the widest temperature range without significant penalties. Applications expecting temperature extremes require either chemistry selection accommodating those conditions or active thermal management.

Replacement cycles must factor into total cost of ownership calculations. LFP's superior cycle life translates to lower cost per kWh-cycle despite similar upfront cell prices compared to NMC. Applications with daily cycling favor longevity over energy density. Procurement departments frequently mishandle this calculation by optimizing for acquisition cost alone. Shorter cycle life proves acceptable in consumer electronics given maximum energy density requirements, as device replacement cycles of 2-3 years tolerate batteries with 500-800 cycle longevity.

Maximum inherent safety becomes essential for consumer-handled devices. LFP chemistry in cylindrical format provides the most forgiving combination. Incident data confirms this configuration as lowest-risk for portable applications. Applications permitting professional maintenance can leverage higher-energy chemistries with appropriate monitoring and fire suppression.